TRAK Solutions

Paycheck Calculator

Clients find it hard to argue with their own data. So why not show them their own paycheck data? TRAK’s Paycheck Calculator is a suite of three separate tools that help a client quickly and easily understand what is being said, find additional funding for retirement, and see how account funds will accumulate until retirement and the income that they will provide. The three tools that make up the calculator include:

- Paycheck Analysis

- 1040 Analysis

- Projection Analysis

Paycheck Analysis

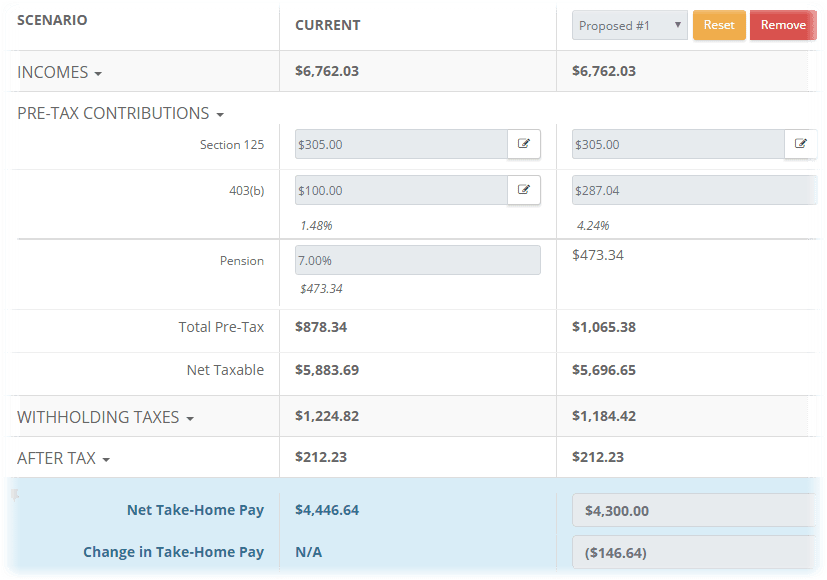

TRAK’s Paycheck Analysis calculator helps advisors lose the “sales speak”. In contrast, the Paycheck Analysis calculator helps advisors engage their clients in retirement planning by first providing illustrations with their own paycheck.

This changes the whole conversation. Typically, when clients observe their paycheck calculated in TRAK, they begin leaning forward, amazed that the numbers match (or nearly match). This exercise fosters trust because the advisor has now presented something that is meaningful to the client. This process has been reproduced thousands of times.

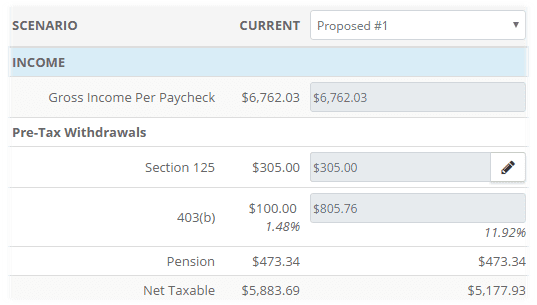

Typically, an advisor will then ask what the client needs for take-home pay. Once entered, the calculator will automatically work backward to calculate the retirement plan contribution. No more guessing.

The Paycheck calculator has many features for customizing a paycheck.

- Include up to three retirement accounts (e.g., a client with a TSA, 457, and pension plan, or a client with a 401(k) and pre-tax pension plan).

- Include Roth accounts.

- Enter retirement contributions as a percentage or as a specific dollar value.

- Itemize Section 125 (Cafeteria) deductions and after-tax deductions.

- Hide fields that are not relevant to a specific employer or state (e.g. state taxes, summer pay, pension plan contributions, etc.).

- Include local taxes and other deductions.

- Apply customizations for states such as Pennsylvania and New Jersey (where tax retirement plan contributions are typically after-tax), Maryland (where local taxes are included in the state withholding tax value), and New York (which has tax tables for some cities).

The Paycheck Analysis calculator was specifically designed to be effective when sitting down with a client. Initially, one paycheck may be displayed. After duplicating a client’s paycheck, which engages the client, you then have the ability to show “what-if” scenarios. You can quickly show the maximum contribution allowed and two scenarios of your choice.

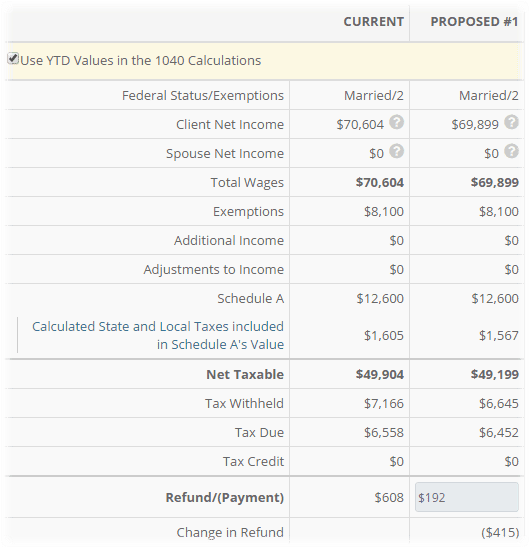

1040 Analysis

Where can a client find additional savings for retirement? While many people live from paycheck to paycheck, they may be able to get a few thousand dollars back in the form of a federal tax refund. TRAK’s 1040 Analysis Calculator can help advisors illustrate this for the client and then move the money.

The 1040 Analysis allows the advisor to set the federal refund value. TRAK will calculate the number of deductions required for the client’s paycheck.

Any additional income calculated is shown to be deposited automatically into the client’s retirement account. Now you have helped your client “find” additional contributions.

Projections

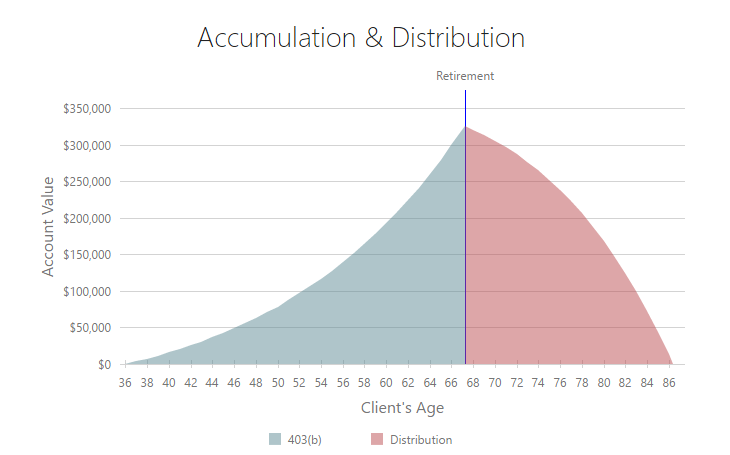

With a click of a button, the advisor can show a client the accumulation and distribution of the account. This helps clients understand how contributions today affect the projected value of accounts at retirement, as well as the projected percentage of income their retirement account will provide during retirement.

This naturally leads to questions about whether the client has additional accounts for retirement. Initially, the client may be apprehensive to disclose this information but will want to see how it impacts the analysis. Additional accounts can be added quickly and easily. Now you can show the whole picture.

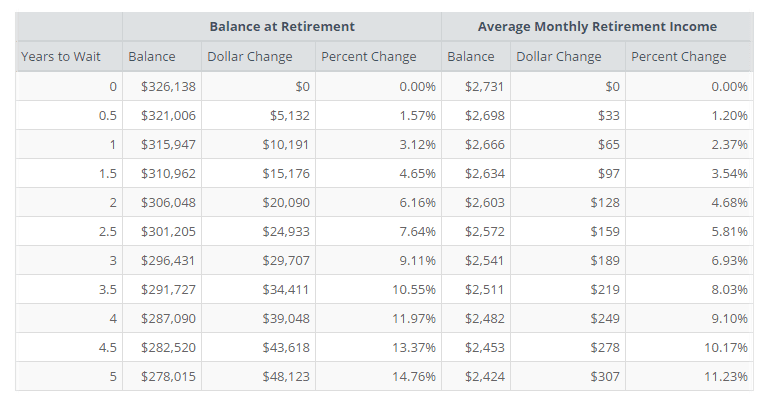

The Cost of Waiting to Save

Often clients have reasons for delaying their retirement savings. Advisors can explain the need for additional savings, stating that in most cases interest will be earned over the longest period of time when additional deposits are made today. But this may be too abstract for the client. With TRAK’s Projection Analysis tool, advisors can show clients the cost of waiting with the click of a mouse button. Clients can instantly see the foregone earnings resulting from a decision to wait one year, two years, or longer. Now you can help clients understand the real cost of waiting to save.