TRAK Solutions

Sequence of Returns

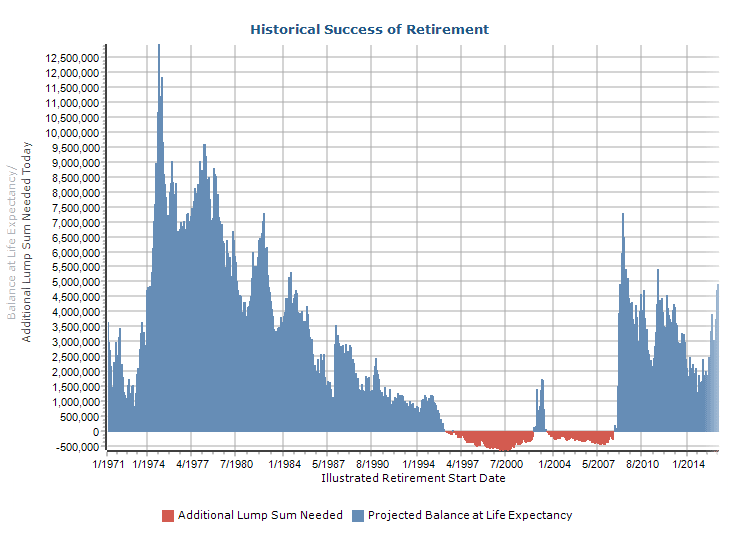

The Sequence of Returns analysis is built into TRAK’s Gap Analysis and Quick Gap calculators. After providing a quick illustration of a client’s retirement using compounded rates of return, the Sequence of Returns solution evaluates a client’s retirement savings using historical indexes (or a blend of indexes). The results display historical success or failure based on the selected index.

First using compounded rates of return and then moving to historical indexes allows advisors to engage clients. The process clarifies what is being communicated and improves clients’ understanding of the risk of sequence of returns.

Assigning hypothetical rates of return is a standard method of illustrating market returns for retirement planning purposes, but this method does not account for periods of market volatility and sequence risk. The retirement account invested in the market may have both positive and negative rates of return at different time periods. If lower or negative returns occur early in retirement, it may have a more detrimental impact on future retirement cash flow.

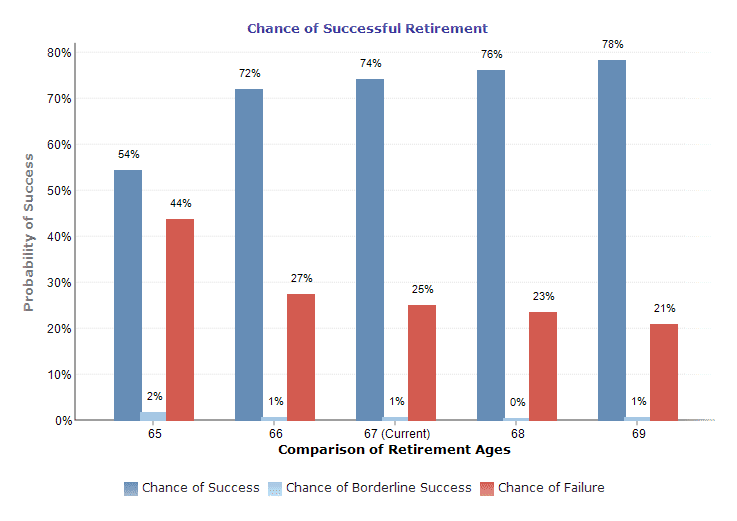

Additionally, factors such as retirement age, life expectancy, and inflation can affect the possible success or failure of a retirement plan. The Sequence of Returns solution compares the success of different hypothetical returns side by side.

Full integration into TRAK’s Gap calculators allows an advisor to input the client’s information only once and then easily illustrate multiple scenarios. The Sequence of Returns calculator is highly configurable and allows for an index analysis and a retirement analysis.

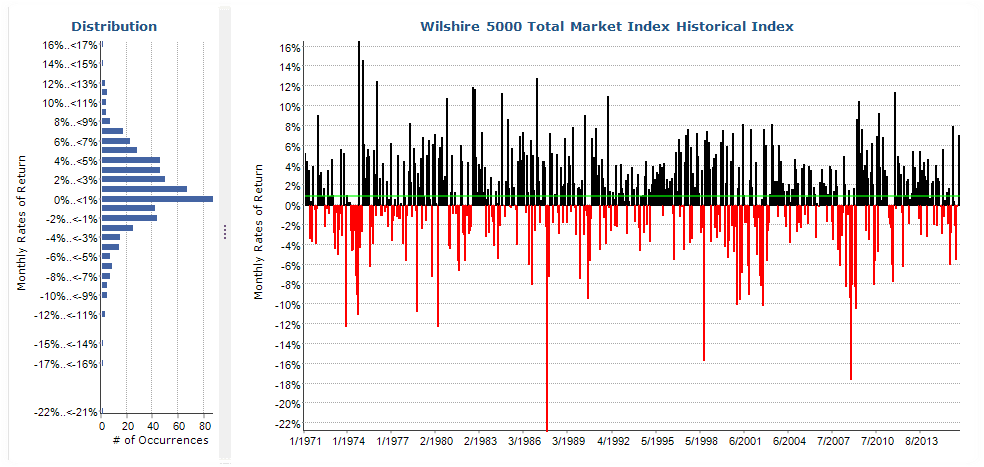

Engaging Visuals Help Clients Understand Market Volatility

Keeping in line with Trust Builders’ philosophy of providing advisors with tools to engage and educate clients, the Sequence of Returns calculator features engaging visuals which allow clients to visualize and understand the complexities of market volatility and its impact on retirement.

Help Clients Understand Their Probability of Success

Advisors can use the Retirement Analysis feature in the Sequence of Returns calculator to analyze a client’s retirement plan against historical rates of return. Powerful visuals engage clients and easily illustrate how factors such as retirement age, life expectancy, and inflation affect the likelihood of success or failure.

As with all TRAK calculators, the Sequence of Returns calculator generates colorful reports that may be printed or saved to share with clients.