FinTech Company Helping Advisors Build Trust with Clients

Dallas, OR: At the 2019 DC Genie Awards, 401kTV named RetireReady Solutions® the winner of the Employee Communication Award. The FinTech award for employee communication recognizes excellence and innovation in the 401(k) industry, specifically for providing tools for advisors and plan sponsors to engage employees in their retirement journey.

“We are incredibly humbled and honored to be recognized by such significant influencers in the retirement industry,” said Edward Dressel, President of RetireReady Solutions. “This award acknowledges that our solutions are truly making a difference in our community and helping people across the country better prepare for retirement.”

“We are incredibly humbled and honored to be recognized by such significant influencers in the retirement industry,” said Edward Dressel, President of RetireReady Solutions. “This award acknowledges that our solutions are truly making a difference in our community and helping people across the country better prepare for retirement.”

Fred Barstein, CEO and founder of 401kTV, stated that RetireReady Solutions was selected for the award because it “helps advisors engage participants in a meaningful and actionable way.” He noted that the firm’s tools help advisors differentiate themselves from competitors in a crowded field.

Advisors and plan sponsors gathered for 401kTV’s inaugural DC Genie Awards in New York City to build awareness around innovation that has improved retirement outcomes. The program highlights the creative use of technology and nurtures collaboration between advisors and plan sponsors. The event will also be held in Chicago and Los Angeles. Details are available online at 401ktv.com/genie-awards.

About RetireReady Solutions

RetireReady Solutions helps advisors build trust with their clients. Founded in 1986 as a retirement investment firm for teachers and other public employees, RetireReady Solutions specializes in retirement modeling, analysis, and illustration software for 401(k), 403(b), and federal retirement plan advisors, agents, and brokers. RetireReady Solutions is committed to continuously improving its solutions and supporting plan advisors with world-class training and support. For more information visit our 401k Solutions Page or call 503.831.1111.

Download a Free Trial of our TRAK Software Today!

Try out the Best FinTech Solution in the 401k market for employee communication

Photos

Top Right: FinTech 401kTV DC Genie Awards Plan Communications panelists from left to right: Jane Hagen, TriStar Trust Bank, Edward Dressel, RetireReady Solutions, and Courtney Gladden, Chepeknik Financial. These industry professionals provided attendees insight into the success they have experienced in communicating with plan participants. Photo provided by 401kTV.com.

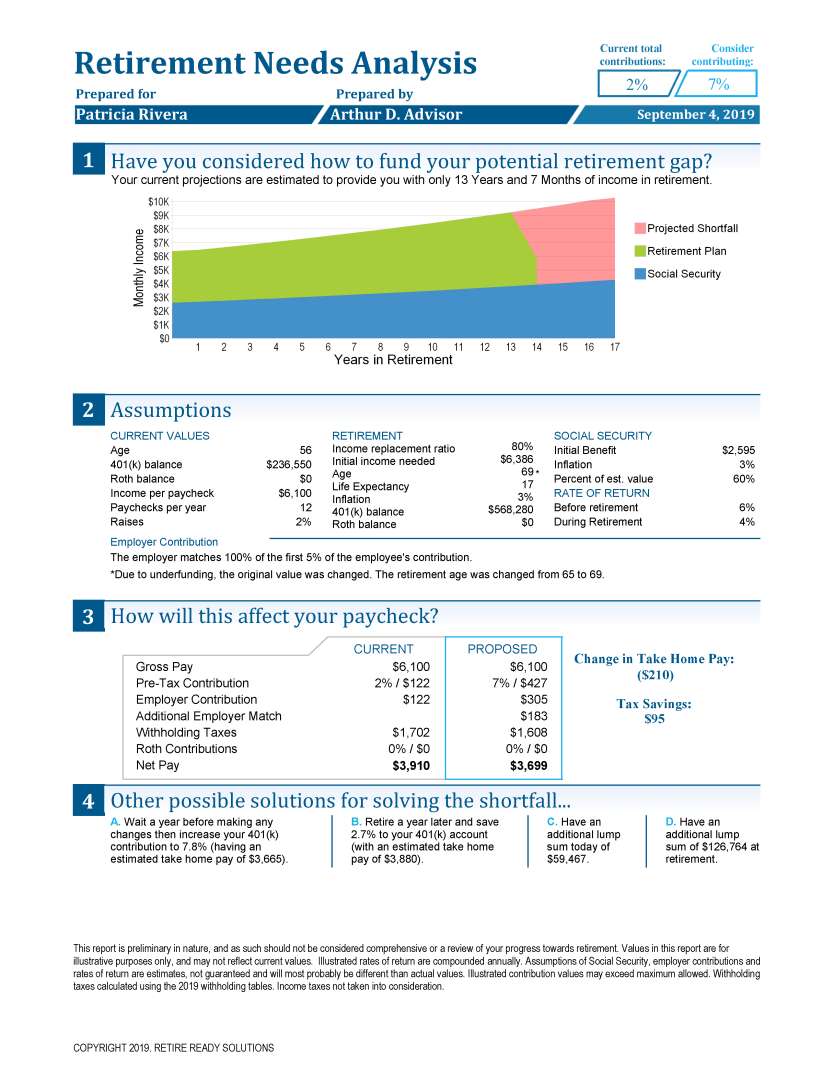

Bottom Right: The Retirement Analysis Kit (TRAK) provides advisors with simple yet powerful reports like the “Retirement Needs Analysis” that engage participants. TRAK has proven to be an effective asset to many advisors seeking to increase participation and contribution rates.