The Bucket Strategy – Part 3

Step by Step Guide Within TRAK

You’ve researched the bucket strategy, you see the potential it has for your clients and your business, and now you need the means to use it. The first two parts of this series explored the strategy and how to introduce it to clients. This final segment provides TRAK users with a step-by-step guide for implementing the strategy.

Part 1: What It Is, and What It Can Do for You | Part 2: Who Wants It and How to Win Their Business

The bucket strategy provides an opportunity to capitalize on longer-term market growth throughout retirement while securing financial stability for the immediate future. This approach can increase returns while easing the fear of risk and the tendency to overreact to market fluctuations. The bucket strategy sets aside assets for the short term, and places assets that are not immediately needed into longer-term, higher-risk investments to yield a profitable rate of return. This approach helps to mitigate any extreme lows or highs of the market during the retirement years.

Watch our video to guide your own implementation of the bucket strategy, or to get a firsthand look at The Retirement Analysis Kit (TRAK) in action.

The Retirement Analysis Kit (TRAK) illustrates ways in which the bucket strategy offers protection against market volatility (e.g., as the Sequence of Returns may illustrate). Typically this is where account assets are, at retirement, used to allocate assets to different time periods (or “buckets”) that will provide income and try to minimize asset loss due to large fluctuations in the market. A typical strategy might be set up as follows:

Now Bucket (Years 1‒5): This bucket is filled with cash accounts that secure a steady cash flow not affected by market changes.

Soon Bucket (Years 5‒15): This bucket is used for bonds, bond funds, etc. that introduce some risk while capitalizing on market gains without jeopardizing present financial security.

Later Bucket (Years 15+): This bucket invests remaining funds in higher-risk accounts, like stocks in a globally diversified stock portfolio. These investments allow the retiree to capitalize on historical growth to replenish the other buckets.

CONFIGURATION

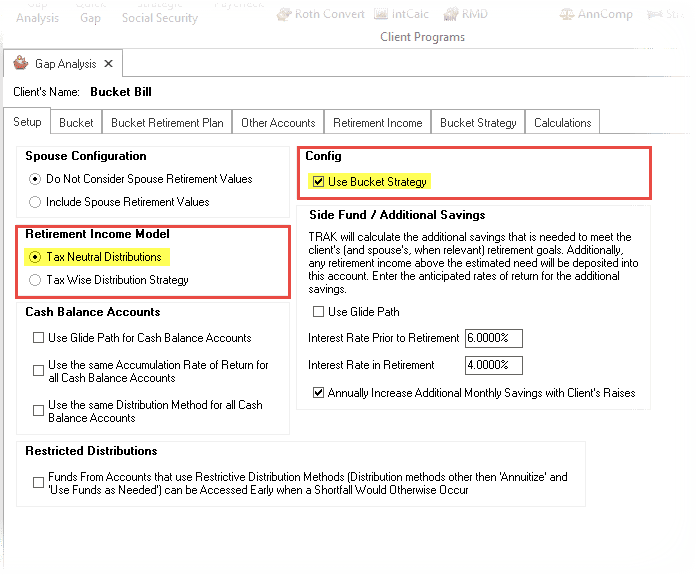

Within the desktop version of TRAK, navigate to the “Setup” tab in the Gap Analysis Calculator and check the “Use Bucket Strategy” box in the “Config” area. A new tab will appear between the “Retirement Income” and “Calculations” tabs.

Note: The Bucket strategy will not be available if the “Retirement Income Model” is set as “Tax Wise Distribution Strategy.”

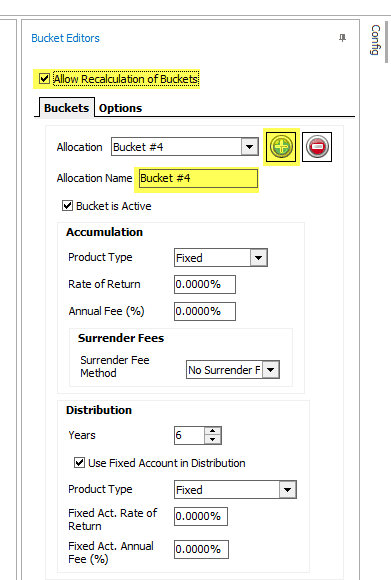

By default, the “Buckets Editor” is initially locked to prevent editing. Check the box “Allow Recalculation of Buckets” to create or edit allocations.

On the left side of your screen, choose when to “Allocate Funding” by selecting one of three options:

- Today – This option uses the accounts to purchase allocations at the current date. Note that not all accounts are available for reinvestment into allocations prior to retirement.

- At Retirement (most common) – This option takes the sum of the accounts’ balances and purchases the allocations at retirement.

- Individually Select – This option allows each account’s availability for funding allocations to be configured separately.

If certain accounts should not be used for funding allocations, drag and drop those accounts into the box “Accounts Not Used to Fund Buckets.” Accounts that are to be used for funding allocations can be reordered.

Note: The graph above shows the unfunded retirement income. This is because all the accounts for funding buckets are pooled together to purchase the allocations, each of which will handle a portion of the shortfall. To configure the chart’s appearance, click on the vertical “Config” tab on the far right. There you can select which elements are visible, determine how the chart displays values, and even assign names to each bucket.

ADDING ALLOCATIONS

To add allocations, click on the green “+” icon on the right of your screen. The first allocation (i.e., Years 1–5) has no accumulation period because it is funded and begins at retirement. If the allocation is for a period of five years, the shortfall amount for those years will be calculated and the amount will be used from the “Funding Available” section, leaving an “After Transfer” balance.

Next, click on the “Distribution” tab to configure the years of distribution (e.g., 5) and decide whether to use “Fixed Account in Distribution.” If checked, choose the “Product Type” (either fixed, indexed, or IRA), “Fixed Act. Rate of Return,” and any “Fixed Act. Annual Fee (%),” if applicable.

The “Options” tab allows further configuration such as the “Retirement Years Method” (12-month periods or calendar years) and the “Account Types”. You can choose to use the same rates of returns method for all CDs/RIAs or customize each.

The “Options” tab allows further configuration such as the “Retirement Years Method” (12-month periods or calendar years) and the “Account Types”. You can choose to use the same rates of returns method for all CDs/RIAs or customize each.

With additional allocations, you may consider the “Accumulation Time.” For example, if the first allocation is for five years starting at retirement, the second allocation will have five years to accumulate before distribution.

On the far right, the vertical “Config” menu allows you to customize bucket names and chart layouts. The “Accumulation & Distribution Editors Display” allows you to control how data is displayed (vertically or on tabs).

Once the buckets have been configured, new illustrations become available in the Calculations reports for “Retirement Years” as well as a report titled “Bucket strategy”

Within the “Retirement Years” page, both the chart and grid view now present your bucket strategy. The grid includes any flex income for handling changes in the COLA, if configured.

The “Bucket Strategy” report provides an overview of the investment strategy, details of the investment strategy, and hypothetical illustrations of how accounts will grow.

The ability to illustrate continued growth throughout the distribution phase of a client’s retirement is a great way to show how invaluable your services are. The growing popularity of the bucket strategy was made evident by the many inquiries we’ve received since rolling out the feature within our TRAK software. Start a free trial today to see how the bucket strategy fits your business.

The Bucket Strategy Series

Part 1 – What It Is and What It Can Do for You

Part 2 – Who Wants It and How to Win Their Business

Part 3 – Step by Step Guide Within TRAK