Showing Projected Monthly Retirement Income Increases Plan Contributions

Plan advisors are always looking for good ways to motivate participants to increase their retirement plan contributions. There are many tactics to accomplish this ranging from advisor-driven approaches such as providing personalized retirement projections to plan-centric approaches like auto-escalation. New research from LIMRA’s Secure Retirement Institute has found another tactic that is proving effective to getting participants to increase contributions: show participants their retirement savings in terms of future monthly income.

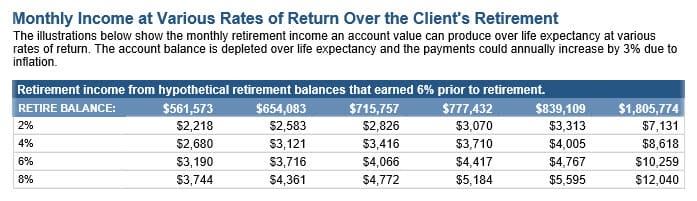

Much of the available participant education materials are either generic or else focus on projected account balances. The LIMRA research is showing that participants have trouble translating account balances into figures they can understand: how much monthly income will this generate. Many advisors show retirement readiness outcomes as whether participants can replace a percentage of their pre-retirement income. While this may be a solid approach for making retirement readiness projections, participants have trouble even doing the math necessary to translate “80% of pre-retirement income” into a dollar figure they can better understand. The research showed that 52% of participants found it difficult to understand how to translate retirement savings into monthly income.

So what difference did showing participants a monthly income projection have on savings rates? The research found that 48% of all participants increased their contributions as a result of seeing their estimated monthly income. The percentage was even higher for younger participants with 55% of millennials increasing their contributions after seeing a monthly income projection.

There are many tactics available to advisors to help participants increase their savings and get on track for retirement. Helping participants understand how their retirement savings might translate into monthly retirement income can be an effective method to motivate them to increase their contributions. Another tool in the plan advisors toolkit.

The Retirement Analysis Kit (TRAK)’s personalized participant reports offer advisors the ability to provide this helpful information to participants. The Contribution Analysis report has several helpful sections showing how a range of contributions will affect a participant’s paycheck today but also the ranges of monthly income that might be afforded at different contribution rates. Advisors using these reports have seen incredible success in increasing both participation and contributions rates.

If you are interested in learning more about our solutions for plan advisors, click here!

Download a Free Trial of our TRAK Software Today!

Try TRAK and see how it can help increase plan contributions with monthly retirement incomes.