This past year, I’ve spoken about employee benefits and retention at several conferences around the country, and I’m particularly interested in the monthly separation rate for government employees. In 2020 and 2022, the numbers spiked, making it difficult for many public employers to maintain their quality of service.

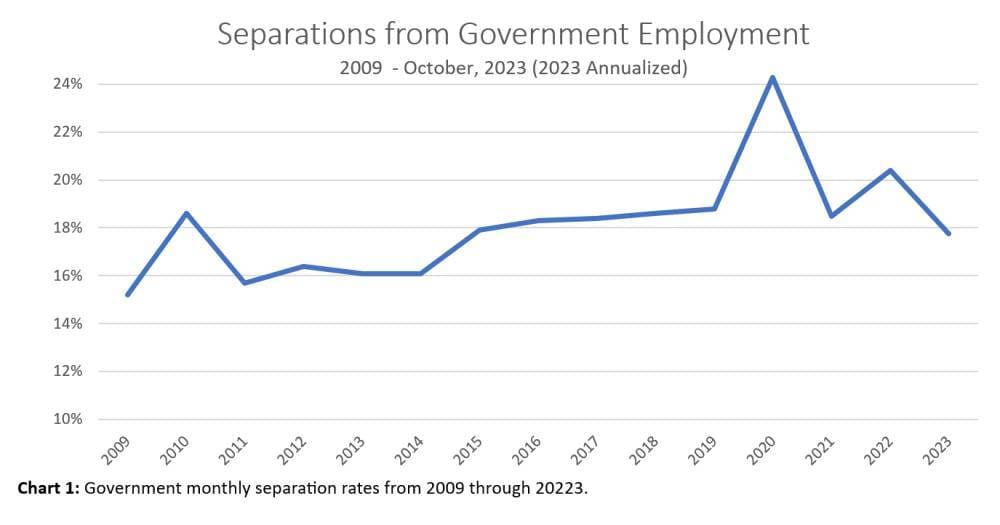

For context, the graphic below charts the annual separation rate from 2009 through 2022. Excluding the spike in 2010, we see a consistent increase in separations from 2009 to 2019, which increased demands on many HR departments. The separation rate spiked in 2020, settled down in 2021, and then increased again in 2022, causing consternation for many.

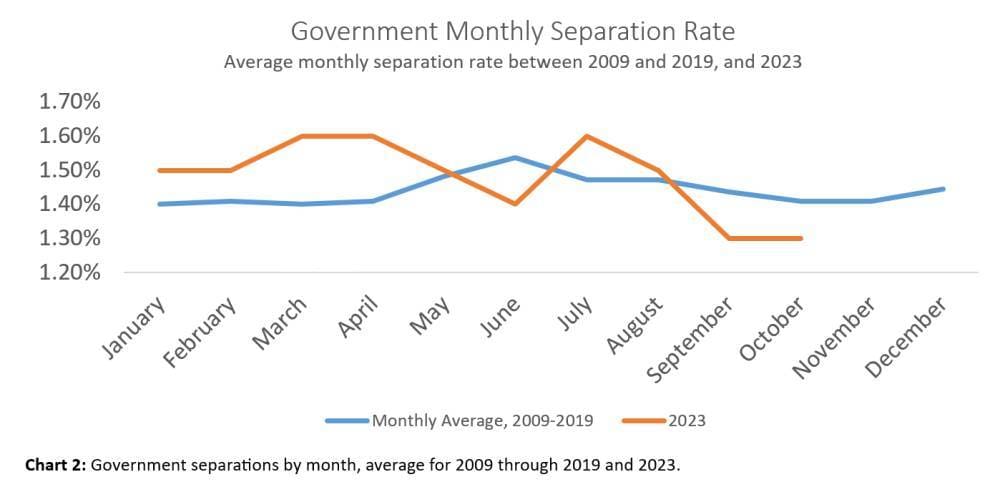

The latest figures just released by the Bureau of Labor are more encouraging. The values for September and October are the lowest of the year, indicating government employees are not leaving their jobs as much as they had previously. The average monthly separation rate for 2023 is just 1.48%, which is lower than any year’s average since 2014.

Note the volatility of the separation rate for 2023, which was exceeded only in 2010 and 2011 (excluding 2020, during the lockdown). This could indicate that we may see a higher end-of-year bounce at the end of 2023 than in other years, or that things may finally be settling down. I look forward to December’s numbers being released in February 2024, when we’ll know whether the typical end-of-year increase has occurred and whether it is higher than normal.

Being aware of what public employers are experiencing can help an advisor better understand and engage the business offices at the school districts they service. Their pension system is a key employee benefit that many of their employees do not understand. Letting the administration know that you will be helping employees better understand their pension should impact employee retention and can help differentiate their services from other advisors, not only with clients but also with the administrative personnel.