Don’t Leave Money in the Room

Description

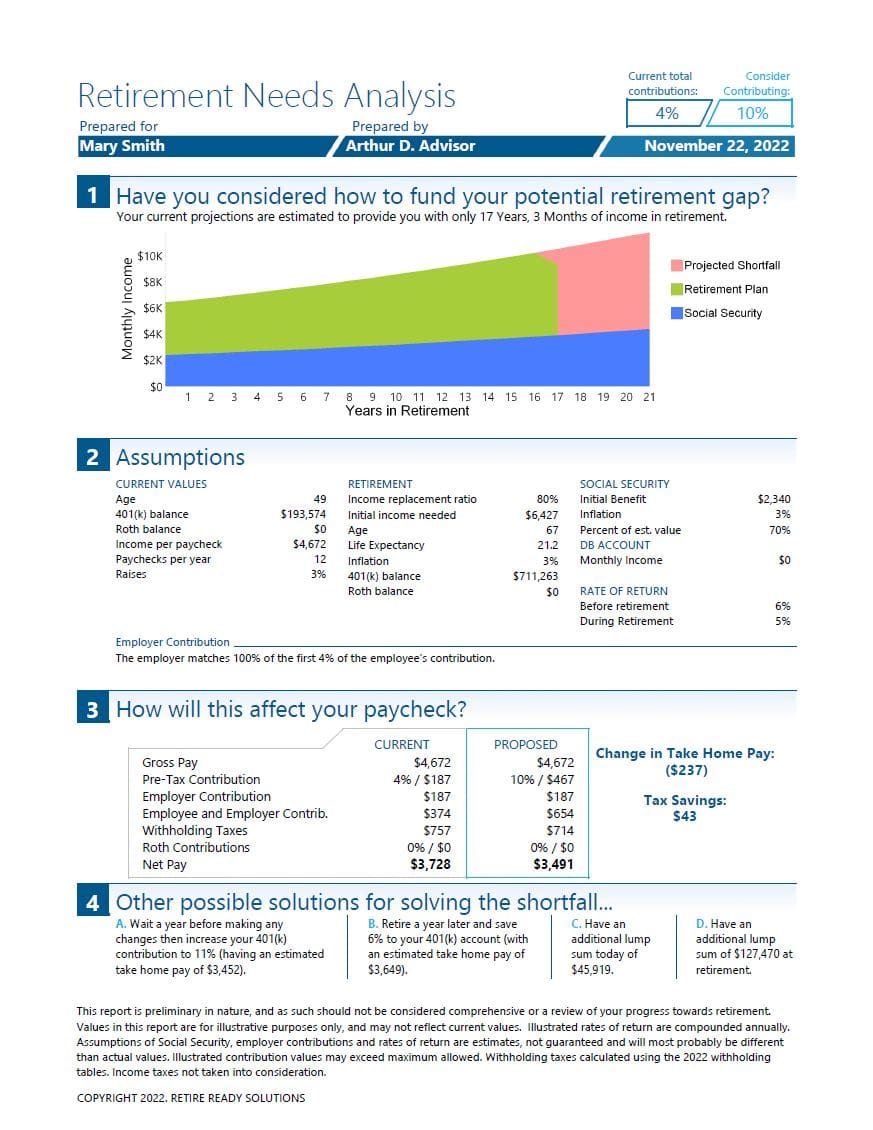

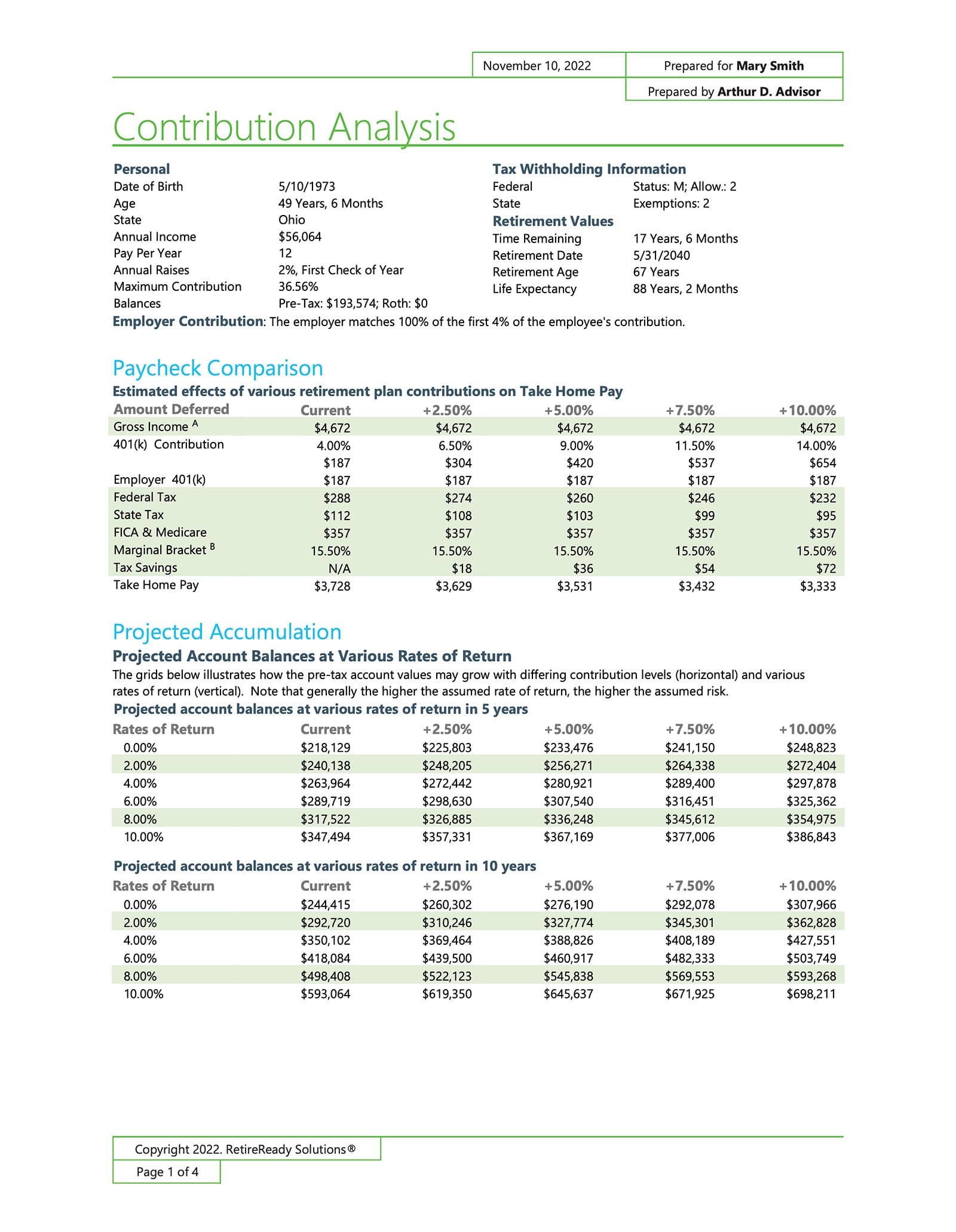

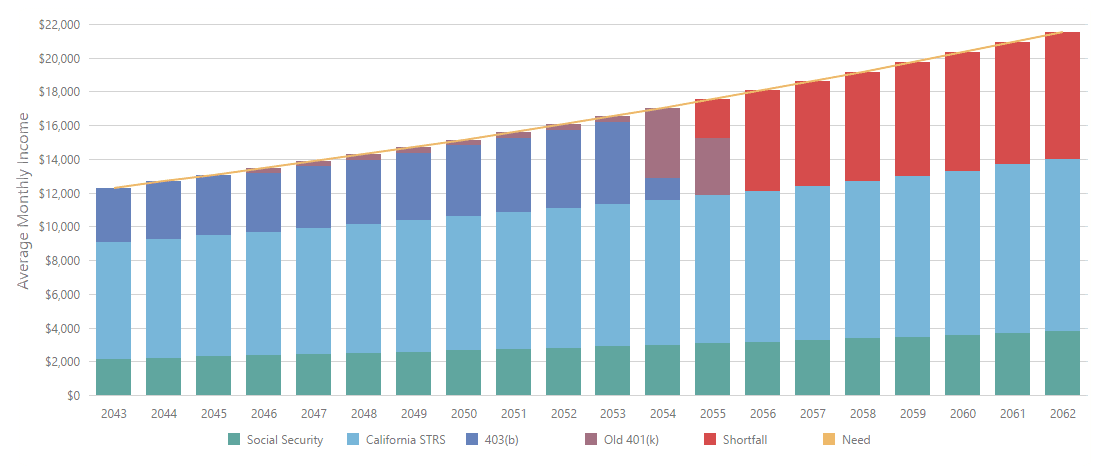

This presentation was given by RetireReady President Edward Dressel. He addresses a major problem many advisors have running participant meetings not retaining engagement and ultimately leaving money in the room. Ed will provide you with actionable tips and tools that are found within our TRAK software and show how they can help you supercharge your participant meetings with better engagement and increased participation.