The key purpose of retirement planning and savings is to ensure a source of retirement income adequate to meet the needs of the individual throughout their lifetime. There are many studies looking at the accumulation period such as how much the average person saves, average account balances, and retirement plan participation rates. There are fewer studies that look at the decumulation period: how do retirees actually convert their savings into income and spend down their retirement savings?

A recent study released by the Employee Benefit Research Institute examines how retirees send down their accumulated assets in the first 18 years after retirement. Contrary to many theories and assumptions that retirees will spend down their assets, the study found that retirees generally did not spend down their assets in these first 18 years. Some of the key findings were:

-

Regardless of the amount of initial assets, assets decumulation was modest across all groups

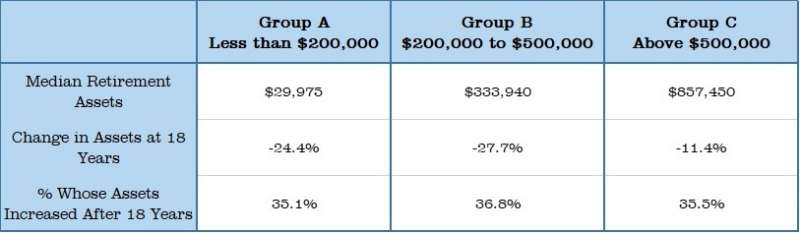

For those starting with fewer than $200,000 of non-housing assets (Group A), the median assets only dropped 24.4%. For those retirees starting out with between $200,000 and $500,000 (Group B), the median assets dropped 27.7%. And for those starting out with more than $500,000 (Group C), the median assets only dropped 11.8%. Of note is the fact that the assets values also include factors such as negative market returns so actual asset spend down may even be less.

-

A significant number of retirees actually increased their assets during this 18 years period

In Group A, who started out with the least assets, 35.1% had more than 100% of their starting assets left by the 18th For Group B, 36.8% had more than when they started and for Group C 35.5% had increased their assets.

-

Retirees with a pension were much less likely to spend other assets

Median assets for those with a pension only decreased 4% over the 18 year period.

-

Retirees tend to limit spending to their earnings

The median ratio of household spending to income ranged between .93 and 1.08 across different age groups. Interestingly, the income measured did not include income from IRAs, 401(k) and other tax-advantaged accounts showing that the retirees limited their spending to income that did not include income from these accounts.

The conclusion is that retirees are hesitant to spend down their assets. There could be several reasons for this such as fear of running out of money, wanting to leave money or heirs, or a poor understanding of what a safe withdrawal rate would be. These findings may open up opportunities for advisors focusing on the decumulation years for understanding the retiree’s income needs and desires and help retirees establish safe withdrawal rates that reflect these needs and desires.

The Retirement Analysis Kit (TRAK) has a number of solutions such as the Gap Analysis that can help advisors educate their clients and create understanding and a plan for managing retirement finances.

Blog Link References:

https://www.ebri.org/pdf/briefspdf/EBRI_IB_447_AssetPreservation.3Apr18.pdf