Retirement isn’t the only thing for which many families are saving; many are also trying to save for their children’s future college expenses. Faced with the need to save for retirement and the desire to save money to help defray soaring college expenses, many families are feeling overwhelmed. If you are an advisor working with mass affluent clients, you are all too aware of this conundrum and the desire of your clients to take finite resources and stretch them to meet multiple needs. One of the most valuable things you can offer a client contemplating these issues is helping educate them on college costs, their savings options, and the effect saving for college will have on other areas such as retirement savings. There may be no easy solution but at least the clients will be well informed as they make their decision.

Cost of a college education

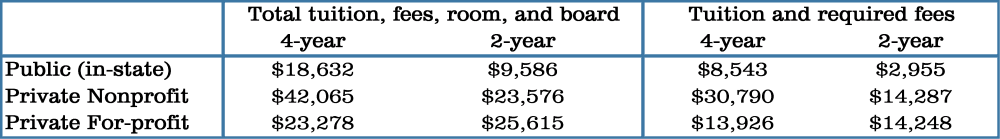

It’s no secret that college is expensive. But many families have little knowledge of the average costs for different types of institutions. Costs can be quite different if the student attends a public or private college, whether they are in-state or out-of-state, whether they live in the dorm or off-campus, or if they start off at a 2-year college and then transfer. Shedding light on these costs can be a big help to clients. Let’s look at some average costs from 2015 compiled by the National Center for Education Statistics.

It should come as no surprise that the average costs for a public institution are substantially lower than the costs at a private institution. Even greater savings can be had at public 2-year institutions where the average cost of tuition and fees was just $2,955.

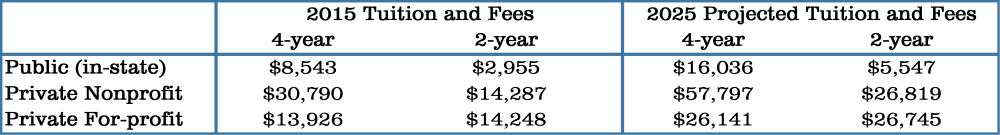

The chart above reflects 2015 costs; those saving for a child’s education down the road will need to consider the inflation of college expenses. The average yearly increase in tuition is 5-8%, far outstripping the average inflation rate and outstripping most families’ annual increase in income. Let’s look at those same costs inflated by 6.5% over 10 years…

It is possible that any savings put toward future college expenses may not be able to match or beat the average rate of inflation for tuition costs.

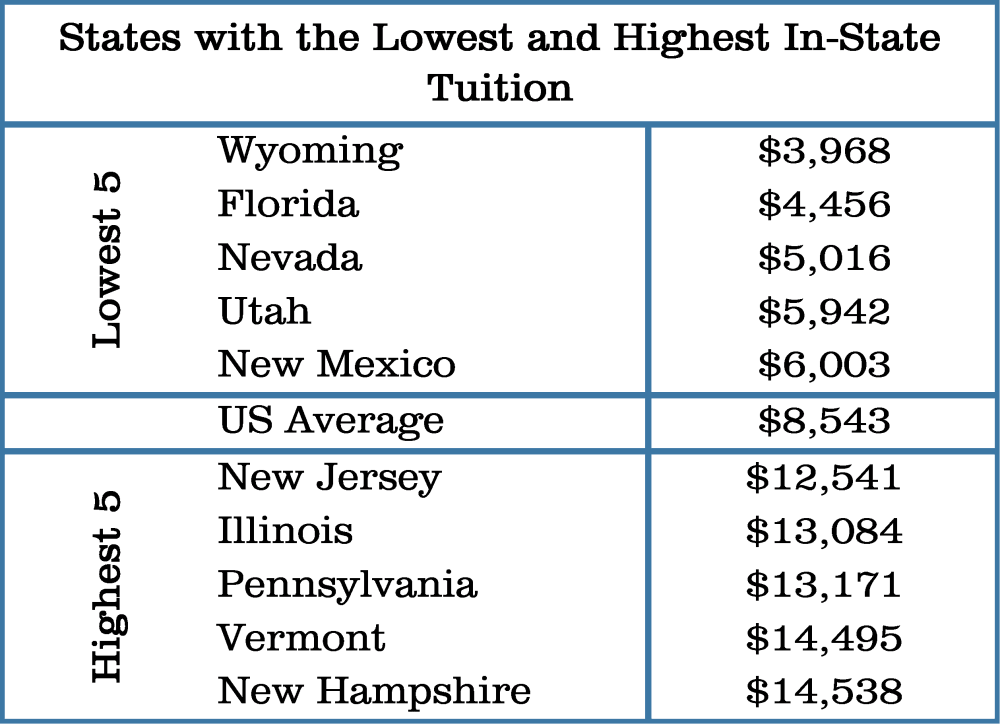

Where you live can also have an impact on college costs with different states charging different tuition rates at public institutions. The grids below illustrate the five least expensive and the five most expensive states for in-state and out-of-state tuition. (Full state list)

Helping your clients understand the average costs of college education and how those costs will increase over time will help them take an unknown cost and actually start putting some figures to it. Planning for these costs will be easier if your clients can actually understand the amount that they are savings toward.

Ways to save for college

There are several different ways a family can save for retirement including 529 accounts, UGMA/UTMA accounts, and education savings accounts. We will focus here on the 529 accounts, one of the most popular choices, which has several key benefits.

The 529 accounts are offered by individual states and are normally open to individuals from any state. The 529 plan comes in two varieties: savings plans that function much like an IRA or other account where contributions are invested in mutual funds or other investments and grow over time (hopefully!); and pre-paid plans which allow a person to pre-pay expenses at in-state colleges or through The Private College 529 Plan.

Saving for college expenses in a 529 account has some key benefits:

- Tax benefits – earnings on contributions grow tax-free and are not taxed at distribution if they are used for qualified expenses like tuition. Many states also offer tax deductions or credits for contributions.

- Account ownership – the parent or guardian is the account owner giving flexibility in naming beneficiaries and deciding on distributions.

- Low impact on financial aid – because the parent or guardian is the account owner, not the child, it is considered an asset of the parent or guardian and so has a smaller impact on financial aid.

- Easy setup – most plans allow you to set up an account online and include age-based options and the option to make regular, automatic investments.

- An exciting possible future benefit would be the availability of 529 account funds for student loan repayment, as recently announced in a bill before the House of Representatives.

For clients who are already maxing out their retirement savings and have paid down any debt, then opening a 529 account can be a simple way to begin saving for a child’s college education. Knowing the type of institution the child may go to and the anticipated costs will give clients a goal to shoot for.

For clients who are already maxing out their retirement savings and have paid down any debt, then opening a 529 account can be a simple way to begin saving for a child’s college education. Knowing the type of institution the child may go to and the anticipated costs will give clients a goal to shoot for.

With the help of an advisor and a good plan, many families can begin saving for a child’s college education without sacrificing retirement savings. This is a valuable gift an advisor can provide to both the parents and the kids!

Although The Retirement Analysis Kit (TRAK) is the foremost retirement planning software, TRAK includes the College Funding calculator because so many retirement savers are also college savers. The College Funding tool will easily allow you to project college expenses and the impact of savings strategies. Give TRAK a try today and start helping your clients save for their children’s college education.