Employer File Editor

The Employer File is at the heart of correctly calculating a paycheck. The Employer File contains the information about a specific employer that is needed to calculate the various aspects of a paycheck, 1040 federal values, and hypothetical projections.

An employer file is used with the Paycheck Calculator (speeding up data and reduces the likelihood of errors) and with the Participant Gap Analysis Report and Contribution Analysis Report (in the Batch Processing calculator).

Editing an Employer File

The Employer File Editor may be accessed by selecting Setup/Employer File... from the ribbon bar or pressing the editor button to the right of the employer file selector in the Paycheck Calculator (shown below).

![]()

| Note: | After an employer file has been created, it may be used in the Paycheck Calculator and when importing client data (accessed via File/Other/Import from File). |

Normally one Employer File per employer will exist and be selected when working with a client's paycheck. In situations where employees are paid differently, more than one employer file may need to be created per employer. This would include when employees have different numbers of pay periods, or when some employees may pay FICA while others may not, etc.

The Employer File toolbar (shown below) buttons (Load, Save, New, Rename, and Delete) each performing their respective action with an employer file.

| Warning: | Once an employer file has been deleted, it can not be restored. |

| Notes: | It is recommended that a custom employer file be created for each employer. This provides several advantages: if an employer file is changed, it effects only the client files associated with that employer file. Additionally it will help the client connect to the illustration. |

| If no changes have been made to the current employer file, the Save button will be disabled (as shown above). |

| An employer file that is currently being used by any client files paycheck can not be deleted (and will not be listed) or if it is the employer file current in the Employer File Editor. |

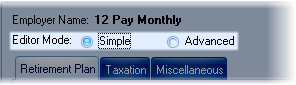

Employer Editor Modes

There are two modes for employer files: Simple and Advanced, selected right below the employer file name.

Simple provides the most typical features needed in many employers, while Advanced allows for more complex scenarios. A comparison of the two editor modes is displayed below.

Feature |

Simple Mode |

Advanced Mode |

|---|---|---|

Section 125 |

Optional |

Optional |

Primary Retirement Account |

|

|

Pre-Tax Account |

Required |

Required |

Custom Retirement Plan |

Optional |

Optional |

Roth Account |

Optional |

Optional |

Secondary Retirement Account |

N/A |

Optional |

Second Retirement Plan |

N/A |

Optional |

Employer Sponsored Retirement Plan |

N/A |

Optional |

FICA/Medicare |

System Default |

Optional, Customizable |

State Taxes |

Optional |

Optional |

Local Tax |

Optional; Max. of 1 |

Optional; Max of 9 |

Summer Pay |

N/A |

Optional |

Pay Schedule |

N/A |

Supported |

Raises |

Supported |

Supported |

Employer Contact Information |

N/A |

Supported |

Below the toolbar bar is the currently loaded employer file. In the advanced mode there are five tabs for configuring the employer file: Visible Fields, Retirement Plans, Taxation, Summer Pay and Miscellaneous.

Each tab is discussed in the respective section below.