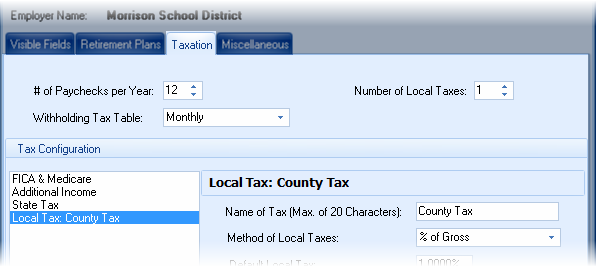

Taxation Tab

Configuration of the employer file editor's Taxation tab determines how the paycheck values are taxed.

| Hint: | Configuring the Visible Fields tab first may simplify the input by reducing the number of inputs that must be configured. |

Each of the inputs are discussed below:

# of Paychecks/Year

Enter the number of regular paychecks the employer pays per year. If an employer has summer pay (or deferred pay), do not include the summer paychecks in this number.

Withholding Tax Table

Enter the withholding table used by the employer. Normally this will correspond with the # of Paychecks/Year but, in some cases, it may be different. For example, an employer paying 13 times per year may use monthly tables (select Monthly), or they may annualize the 13 pay periods (select Payroll Periods).

Number of Local Taxes

If local taxes are visible, this prompt will be enabled. Enter the number of local withholding taxes (e.g. county tax, worker's comp, etc.). A local tax will show in the Tax Configuration list for each local tax item.

Tax Configuration

In the Advanced editor mode, there are four types of tax editors that can be configured. (When Simple is selected as the Editor Mode the State Withholding Tax and one Local Withholding Tax are the only two items available, with each of them being optional). Each tax item is discussed below.