Retirement Plans Tab

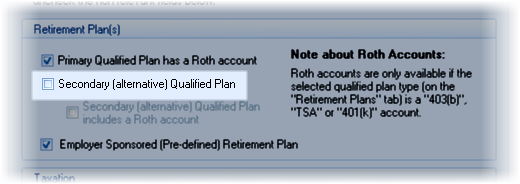

The Retirement Plans tab is where information about the employers' retirement plans are configured. The Secondary Retirement Plan and Employer Sponsored Retirement Plan are only available when Advanced is selected as the Editor Mode.

TRAK allows for up to 3 different retirement plans. They are:

1.The primary retirement plan is the plan an agent is illustrating to a client. This is the account that the advisor typically works with (e.g. 401(k), TSA or 457).

2.The secondary retirement plan is an alternative retirement plan an agent is illustrating to a client. For example, if the primary plan is a 403(b) plan, the client may have an option to make additional contributions to a 457 plan.

3.The third retirement plan would be an employer sponsored retirement plan (such as a state defined benefit retirement plan) that the agent is not involved in.

| Hint: | Configuring the Visible Fields tab first may simplify the input by reducing the number of inputs that must be configured. For example, in the image above the Secondary retirement plan prompts are disabled because on the Visible Fields tab the Secondary Qualified Plan was not checked. |

|

The input data is discussed below:

Primary and Secondary Plans

There are two employer plans an advisor may work with that may be configured, the second one being optional (configured in the Visible Fields tab). Each prompt is discussed below:

Qualified Plan Type

Select the type of qualified plan. To choose a custom retirement plan (which allows for more complex defined contributions plans), select Custom Plan from the drop down list. Then select the plan from the next prompt. (See the Custom Retirement Plan prompt for more information on custom plans).

Custom Retirement Plans are configured in Setup/Custom Retirement Plans, and may be preferred for several reasons:

1.They allow for more complex employer contributions (tiered, conditional contributions, profit sharing, Roth matching, etc.) than the employer file editor provides.

2.They are selectable in the Quick Gap and Gap-Analysis calculators.

3.They only need to be configured once when used with different employer or client files.

The Custom Retirement Plan editor is enabled when Custom is selected in the Qualified Plan Type selection prompt. The Custom Retirement Plan editor can be accessed by clicking on the editor button on the right side of the Custom Retirement Plan selection box

![]()

or pressing Ctrl-Enter when the editor is focused.

Employee Pre-Tax Contribution Method

Enter the default method by which the employee's contributions are made: Percent of Paycheck or Dollar Value. This will control the method for how the contribution is entered in the Paycheck calculator.

| Note: | Normally, 401(k) plans would use the Percent of Paycheck method and 403(b)/TSA plans would use Dollar Value. |

| The selected method can be overridden in the Paycheck calculator. |

| Notes: | The following prompts are enabled if Custom Plan was not selected as the Qualified Plan Type: |

| The employer matching contributions only match the the pretax contributions. It does not match any Roth contributions. If the employer matching contributions include matching the employee's Roth contribution, a custom retirement plan must be used |

Matching (%)

Enter the percent that the employer matches of the employee's pretax contribution.

Maximum Percent Match

Enter the maximum percent of the employee's contribution that the employer's matching is calculated.

|

Maximum Dollar per Paycheck

Enter the maximum dollar per paycheck that the employer will contribute.

Employer Contributions (regardless of employee's contributions)

Dollar Contribution

Enter the per paycheck dollar contribution made by the employer.

Percent Contribution

Enter the percent of the employee contribution that the employer contributes to the retirement plan.

Roth Contributions

Employee Roth Contributions Method

This is the default contribution method for Roth contributions (either Dollar Value or Percent of Paycheck).

| Note: | This prompt will be enabled if the Roth account option is checked in the Visible Fields tab. |

If the employer matches the employee's contributions toward the Roth account, select "Yes" to enable. This allows the employer match to the Roth without setting up a custom plan.

Employer Matches Employee Contributions to the Roth Account

Uncheck this box if the employer does not match Roth contributions to the Roth account. Note that employer contributions are deposited to the pre-tax account.