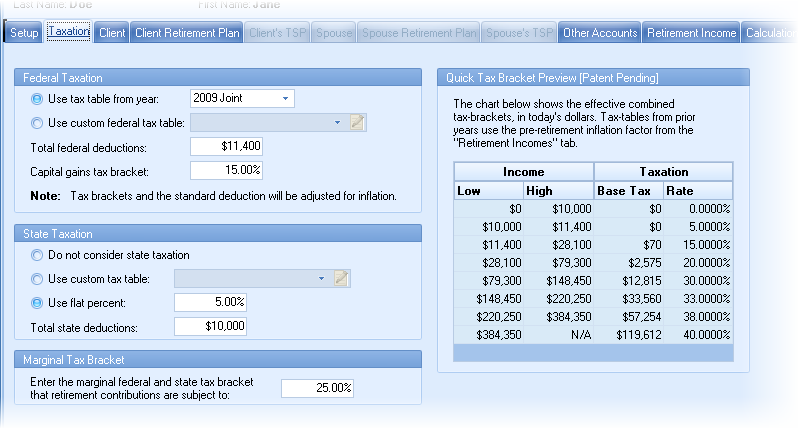

This tab configures the client's taxation during retirement.

TRAK Tax Wise Distribution Strategy works by strategizing a client's distribution in retirement to a specific set of tax tiers. The "Taxation" tab configures the client's tax tables for retirement.

Federal Taxation & State Taxation

These inputs allow for configuring the tax tables. For creating custom tax tables, select the custom option. The custom table editor may be configured by clicking on the editor button on the right side of the custom tax table selection box.

The editor may also be accessed by selecting File/Config from the ribbon bar and selecting "Gap Analysis/Retirement Tax Tables" in the navigator on the left).

Marginal Tax Bracket

The Marginal Tax Bracket will be used to make recommendations where additional savings should be deposited.