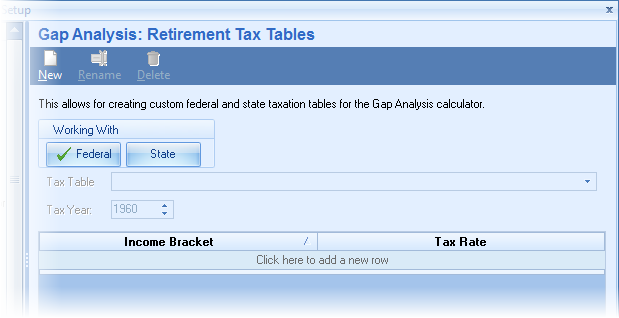

The Gap Analysis calculator allows for calculating a client's retirement income needed on an after tax basis. TRAK comes with built in federal tax tables. Custom federal and state withholding tax tables may also be used.

To create a new table, select which tax table type to create ("Federal" or "State") and click the "New" button at the top of the dialog.

Enter the tax tier information in the grid below.

| Notes: | Be sure the highest tax tier has a very high income level (e.g. $999,999,999) otherwise high income levels will not be taxed when the tax table is used. |

| Rows (records) in the grid can be deleted by clicking on the desired row and pressing Ctrl-Delete. |