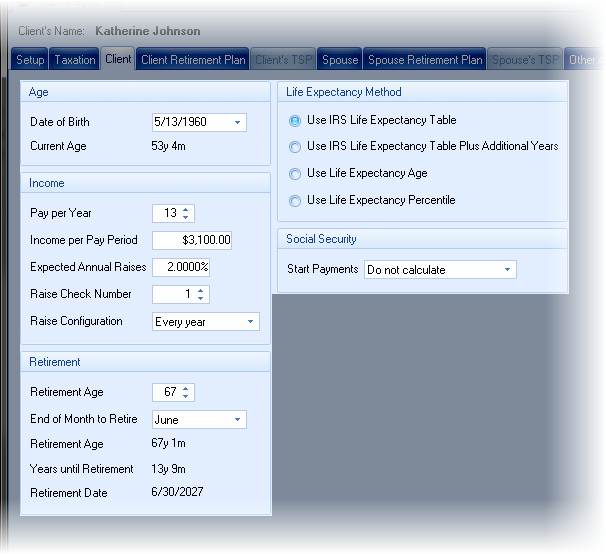

The Gap Analysis Client and Spouse tabs are used for data input about the respective person.

The data entry is identical in both tabs and is discussed in detail below. Prompts below discuss the prompts as if they were for the client. Substitute the word "spouse" for "client" when relevant.

| Note: | The Spouse and Spouse Retirement Plan tabs are disabled if the illustration is configured in the Setup tab to not include the spouse in the illustration. |

Data Input

Date of Birth

Enter the client's (or spouse's) date of birth.

Income

Pay per Year

Enter the number of times the client is paid per year.

Current Monthly Income or Income per Pay Period

If the client is paid 12 times per year, the prompt will appear as Current Monthly Income; otherwise, it will show as Income per Pay Period. Enter the income per pay period.

| Note: | If the retirement income is entered as a percent of retirement income (on the Retirement Incomes tab), the configuration of the following prompts can have a significant impact on how much income the client needs in retirement, especially for younger clients: the smaller the raise or the less frequent the raise, the less the income the client will need in retirement, and therefore they may need less additional savings. |

Anticipated Annual Raises

Enter the value of the anticipated annual raises until retirement.

Raise Check # or Month Raise Occurs

Prompt will change depending upon the value entered for Pay per Year (the later prompt showing up when the client is paid 12 times per year).

Enter/select the check number on which the raise occurs.

Raise configuration

The raise can be configured to occur Every Year, Every Other Year, Every Third Year, or Wait Until Date (no raises occur until a future date, as entered in the next prompt).

Delay next raise until

This prompt is available if Wait until date is selected for the Raise configuration. Enter the date to delay the next raise until on or after.

Retirement

Retirement Age

Enter the age the client will be at retirement.

End of Month to Retire

Enter the end of the month on which the client will retire.

| Example: | If a client is born on March 15, 1960, and plans to retire at age 60, their 60th birthday would be March 15, 2020. If March is selected as the Retirement month, their retirement date would be 16 days after turning 60 (March 31, 2020). If February is selected, their retirement date would fall in the following year (February 28th, 2021), 15 days before they turn 61 years old. |

Life Expectancy Method

There are four possible methods used to determine the life expectancy of the client (or spouse) at retirement:

IRS Life Expectancy Tables

This is the life expectancy of the client at retirement. Note that if the retirement age changes, the life expectancy date of the client will also change.

IRS Life Expectancy Tables plus Additional Years

This is the same as IRS tables, plus a number of years. Enter the number of years in the prompt to the right. Again, if the retirement age changes, the life expectancy date of the client will change.

Enter Life Expectancy Age

Enter the age of the life expectancy of the client.

Enter Life Expectancy Percentile

Enter the percentile of life expectancy will live to. For example, a value of "90" for percentile would indicate that at retirement they expect to outlive 90 percent of the population.

Social Security

Start Method

There are five methods for determining the start of Social Security:

Do Not Calculate

Social Security will not be considered as an income during retirement.

Retirement or 62 (later of)

Social Security will start at the later of retirement or age 62.

Age no Penalty Occurs

TRAK will start Social Security at the age when no penalty occurs.

Specific Age

When this is selected, a box to the right will appear. Enter the age that Social Security will start. (Social Security will not start before age 62, even if the age entered is less than 62).

Strategic Social Security Models

This method allows using selected scenarios from the the Strategic Social Security calculator.

| Note | This option is only available if there are selected scenarios Strategic Social Security calculator. |

Age to Start Payments

This prompt is displayed if Specific Age is selected for the Social Security's Start Method. Enter the age to start Social Security.

Value Method

If the Social Security Start Payments is Do not calculate, this prompt will be disabled. Otherwise, select from one of the methods listed below.

Enter Values at Retirement

Enter the values of Social Security at retirement.

Enter in Today's Value

Enter the value of Social Security in today's dollar values. TRAK will increase by the pre-retirement cola the value until retirement limited by the maximum Social Security (set in the Gap Analysis/Calculator configuration).

Calculate

TRAK will estimate the Social Security income. Click here for information on how TRAK calculates Social Security. Additional prompts are available when calculating Social Security:

Income Years for Social Security

Select the number of years the client has income subject to Social Security taxation. The minimum to qualify for Social Security is 10 years, the maximum used to calculate Social Security is 35.

Subject to Windfall Elimination Provision

If a client has less than 30 years of substantial income (as defined by Social Security), check this box and select the number of years in the Number of years of substantial earnings at retirement prompt.

Percent of Calculated Value

If the Calculation Method above is Calculate, this prompt allows for setting Social Security to a percent of the calculated value. This may be desired when working with younger clients who want to reduce their dependence on Social Security. For example, if TRAK calculates Social Security to be $4,000 at retirement, and the value for Percent of Calculated Value is 60%, Social Security would start as $2,400 at retirement.

Monthly Value

This prompt is only displayed if Enter in Today's Value or Enter Value at Retirement is selected in the Calculation Method prompt above. Enter the monthly value for Social Security, either in today's values or the value at retirement.