CashActContributions

Contribution Method

Select Percent of Pay, Dollar or Maximum for the contribution method.

| Note: | The Maximum method limits contributions based on the retirement plan type (e.g. for 2022 the 401(k) participant contributions are limited to $20,500) but is not limited by earnings. |

| The Maximum method is indexed to inflation (which can be configured in File/Config/Gap Analysis/Calculator). |

| If there is a Roth account in addition to the pre-tax account, selecting Maximum now allows the ability to split the % between both. |

| Note: | If the Maximum method is selected for the pre-tax account, the Roth account contribution method is not available. |

Contribution(s) per Year

Enter the number of times a contribution is made per year. Note that if Percent of Pay is selected as the Contribution Method, this prompt will not be available.

Contribution Value

Enter the value of each contribution: for the deposit type "Dollar," enter the dollar contribution. For the deposit type "Percent of Pay," enter the percent of pay that the employee contributes.

Change Future Contributions

Check this box to illustrate changing contributions in the future. An additional prompts starting with the period of time the change will occur and how the contribution method will change.

Annual Increase Method

Select the method for increasing the client's contribution in future years. Each method is discussed below.

No Increase

Select this method if there is to be no future increase in the contribution value. Note if the Contribution Method for the client is Percent of Pay and the client (spouse) has a raise, the dollar value of the contribution will increase when the client receives a raise, but the percent of the client's (or spouse's) pay will remain the same.

Increase in Value

This method will increase the value of the client's contribution as a value. If the Contribution method is Dollar then the increase value will be in a dollar value, and will be per contribution. If the method is Percent of pay then the contribution will be an increase in the contribution percent. Contribution increases occur when the client receives a raise.

| Examples: | If a client is currently contributing $100 monthly and selects Increase in value with a $25 increase, the future contributions will increase to $125 per contribution the first year, $150 the second year, $175 the third year, etc. |

| If a client is currently contributing 5% per paycheck and selects Increase in value with a 1% increase, the future contributions will increase to 6% the first year, 7% the second year, 8% the third year, etc. |

Percentage Increase

This method will increase the contribution by a specified percent. Increases occur when the client receives a raise.

| Examples: | If a client is currently contributing $100 monthly and selects Percentage Increase with a 10% increase in percentage, the future contributions will increase to $110 per contribution the first year, $121 the second year, $133.10 the third year, etc. |

| If a client is current contribution 10% of their paycheck and selects Percentage Increase with a 10% increase in percentage, the future contributions will increase to 11%, 12.1%, 13.31%, 14.46%, etc. |

Detail Customization

This allows customizing the future changes in contribution in as much detail as desired.

If Annual increase method is either Increase in value or Percentage increase, the following prompts will be enabled:

Annual increase in percent, Annual dollar increase in each deposit or Annual percentage increase

Enter the value to increase the contribution. This field is not available if Detail customization is selected for the Annual increase method.

Number of years to increase contributions

Enter the number of years to increase contributions. This field is not available if Detail customization is selected for the Annual increase method.

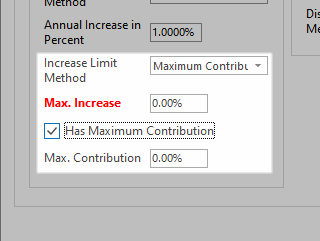

Increase Limit Method

Select either Number of Years or Maximum Contribution Increase.

If Maximum Contribution Increase is selected, the following prompts will be enabled:

Max. Increase

Enter the maximum desired increase in contributions

If Has Maximum Contribution is selected, an additional prompt will appear to enter that value.

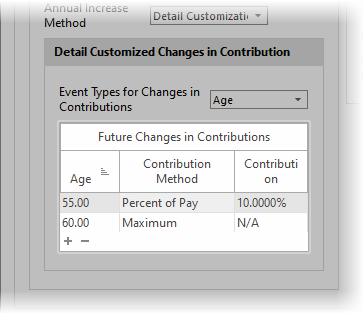

If Annual increase method is Detail customization, the following box will appear.

This dialog allows customizing when the contributions will change (either increase or decrease) at any point in the future. The prompts are discussed below.

Event types for changes in contribution

The events for increasing contributions are Age, Year and Date.

The columns in the grid are:

Age, Year or Date

The column type here corresponds to the method selected in the previous prompt and is when the change in contribution occurs.

Contribution type

Select if the contribution is a Specific Value or the Maximum Allowed. (For Maximum Allowed, see notes above under Contribution Method about Maximum).

Dollar Contrib or Percent Contrib

The value here corresponds to the Contribution method selected previously. If the Contribution type is a Specific value, enter the value the contribution will change to.