The prompts that appear may be different than listed below, depending on the properties of the selected retirement plan:

Pre-Tax Account Balance

Enter the current retirement plan account balance.

Pre-Tax Elective Contribution

| Note: | Using the drop-down menu on this prompt, the Contribution Method can be configured as a Percent of Income (default method) or as Dollar per Paycheck. Additionally, the Contribution Increase Method can be configured to be No Increase (default method), or one of two methods to increase when the client receives a raise. The methods are Increase Contribution by Value or Increase Contribution by Percentage (explained below). To configure the contribution method or increase method, click on the down arrow on the right side of the Pre-Tax Elective Contribution editor (or press Ctrl-Down Arrow for the menu to appear). |

Enter the employee's elective contribution to the retirement plan. If the edit mask shows a percent, enter a percent of pay. If it is a dollar edit mask, enter the contribution per paycheck.

If Contribution Increase Method is configured (in the drop-down menu in the Pre-Tax Elective Contribution editor) to have an increase, one of the two following prompts will appear, followed by the # of Years prompt. Note that the contribution increase occurs when the individual is schedule to receive a raise (configured in the Expected Average Raises prompt).

Annual Increase per Paycheck

This prompt will appear if the Increase Contribution by Value is selected for the Contribution Increase Method in the pop-up menu under the Pre-Tax Elective Contribution prompt (above).

Enter the annual increase in the value of the contribution.

Annual Percentage Increase

This prompt will appear if the Increase Contribution by Percentage is selected for the Contribution Increase Method in the pop-up menu under the Pre-Tax Elective Contribution prompt (above).

Enter the percent to increase the annual contribution.

# of Years

Enter the number of years that the increase in contributions are to occur.

| Examples: | The table below shows how increases to contributions affect the two different contribution methods (Percent of income and Dollars per Paycheck). The examples assume that the # of Years prompt has a value of at least 3. |

Percent of Income |

Dollars per Paycheck |

|||

Increase Method |

...by Value (1%) |

...by Percentage (10%) |

...by Value ($25) |

...by Percentage (10%) |

Current Contribution |

3.0000% |

3.0000% |

$100 |

$100.00 |

With Next Raise |

4.0000% |

3.3000% |

$125 |

$110.00 |

With 2nd Raise |

5.0000% |

3.6300% |

$150 |

$121.00 |

With 3rd Raise |

6.0000% |

3.9930% |

$200 |

$133.10 |

| Note: | This prompt is only displayed if the selected Retirement Plan allows for participant elective contributions. |

Pre-Retirement Rate of Return

Enter the hypothetical rate of return earned on the money until retirement.

| Note: | The following prompts may or may not appear on the screen depending upon which retirement plan is selected. |

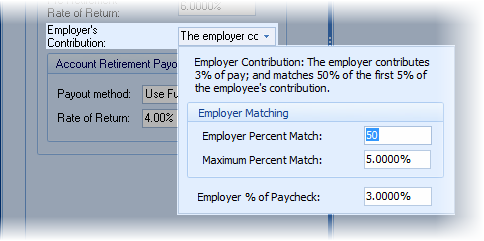

Employer's Contribution

This prompt will be displayed for define contribution plans that allow the employer contribution to be configured. To configure the employer contribution, click on the down arrow to the right of the edit window (or pressing any key while the editor is focused). The following prompts are displayed:

The following two prompts are in the employer matching group:

Employer Percent Match

Enter the percent of the employee's contribution that the employer matches.

Maximum Percent Match

Enter the maximum percent of the paycheck that the employer will match.

Employer % of Paycheck

Enter the percent of paycheck amount the employer contributes.

Employee Class

This prompt will be displayed for custom defined contribution plans (defined in Setup/Retirement Plans) with Employee Class method of profit sharing. Select the class of employee for the applicable profit sharing rate.

Payout Method

There are various distribution methods for accounts with cash balances at retirement. The following is a list of the methods and brief descriptions. Note that all payout methods (except 'Annuitize') may be subject to RMD, which may affect the goal of the selected method.

Annuitize: This annuitizes the account over the life expectancy of the owner. The value entered is the payout in dollars per thousand per month.

Use Funds as Needed: Funds are distributed as needed.

The following distribution methods are categorized as restrictive distribution methods. This means that funds are not available for distribution if the restrictions on distribution have already been met.

| For Example: | If the distribution method is Retain Principal, the distributions are limited to reducing the cash balance of the account to the value it was at retirement. In the Gap Analysis calculator's Setup tab, this may be configured to allow distributions from an account as a last priority in the Restricted Distribution dialog box. |

Retain Principal: This limits distributions to the interest earned .

Amortize, no inflation: Equal payments are made over retirement years. The payment is calculated so that at life expectancy the account will be depleted.

Amortize, with inflation: Equal payments over retirement that are annual adjusted by inflation. The payment is calculated so that at life expectancy the account will be depleted.

Percent of Account: Allows for a specific percent of the account balance to be paid out each year during retirement. If the need is less than the calculated annual distribution, the distributions may be less than the specified percentage.

RMD Only: Only Required Minimum Distributions are made from the account. Note that these are made on the last payment of the calendar year.

Dollar Value, No Inflation: A specified dollar distribution per month over retirement. No adjustments are made to the distribution.

Dollar Value with Inflation: A specified dollar distribution per month over retirement with annual inflation adjustments made to the distribution.

TSP Life Annuity: This option is available when working with the TSP Plan (or Federal Summary Account) in the Gap Analysis calculator. An additional prompt will be displayed to select which TSP annuity.

Summary of Retirement Payout Methods

Payout Method |

Has Cash Balance |

Restricted Distributions |

Annuitize |

¨ |

N/A |

Use Funds as Needed |

þ |

¨ |

Retain Principal |

þ |

þ |

Amortize No inflation |

þ |

þ |

Amortize with inflation |

þ |

þ |

Percent of Account |

þ |

þ |

RMD Only |

þ |

þ |

Dollar Value, No Inflation |

þ |

þ |

Dollar Value with Inflation |

þ |

þ |

TSP Annuity |

¨ |

þ |

Note: Selected distribution methods can be hidden from the list in the File/Config/Gap Analysis/Calculator.

Rate of Return or Annuity Rate

Enter the Rate of Return (or Annuity Rate, depending upon the Payout Method selected) during retirement.

Annual Percent to Distribute

If the Payout Method is Percent Of Account, enter the percent of the account to payout each year.