Understanding Additional Savings Needed

When I try to solve for the retirement shortfall with the values TRAK recommends, there is still a retirement shortfall. Why?

When running an illustration with a projected shortfall TRAK will calculate three different ways of solving for the shortfall:

1.additional monthly savings needed between now and retirement,

2.additional monthly savings starting in 12 months (where the number months is configurable on the "Overview" calculation page),

3.additional lump sum needed today, and

4.additional lump sum needed at retirement.

Adding any one of these additional assets to the illustration may still result in a shortfall, or may result in over-funding of their retirement. This may be caused by a number of different reasons:

1.The projected additional savings may require an annual increases (correlated with the client's raise) in the contribution while the new savings does not include an increase.

2.The interest rate on this and other accounts,

3.The distribution order of the accounts.

4.A cash account's Retirement Distribution method. If the method is something other than Use Funds as Needed, the account may not be permitted to distribute funds when they are needed.

For Example

A client earns $5,000 a month with an anticipated raise of 3% (that occurs at the end of next month) turns 50 years old today (happy birthday!) and plans on retiring in 15 years (at the age 65 of age). They want 80% of their income at retirement, do not want to include Social Security in their illustration, and do not have a retirement account. They only have an "Old 401(k)" account worth $650,000 with projected earning of 5% before retirement and 3% during retirement. (The account's projected retirement value will be about $1,350,0001). The rates of return on the additional savings (in the Quick Gap calculator the Side Fund/Additional Savings is found at the top of the Other Accounts tab, and in the Gap Analysis calculator it is found on the Setup tab) are 6% before retirement and 4% during retirement.

TRAK will calculate they need to save about $540 per month until retirement (or have about $194,000 more money at retirement). They client agrees to this, and a Retirement Investment account is added with the monthly deposited and earning the same rates of return as the Additional Savings. Returning to the calculations, TRAK still shows additional savings needed. What happened?

There are three items to look at.

1.One item to look is to go to the "Other Account" tab and under the "Side Fund/Additional Savings" section see if the "Annually Increase Additional Monthly Savings with Client's Raise" is checked. Un-checking this will recalculate the savings needed and result in increased monthly savings required (because their are no projected increases in the future savings).

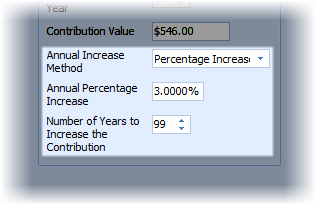

2.Alternatively, to apply the increase to the new Retirement Investment, select the account, and in the Contribution section, for Annual Increase Method select Percentage Increase and enter 3% for Percentage Increase and enter 99 for Number of Years to Increase the Contribution.

3.The interest rate on this new account matches the rate on the "Side Fund/Additional Savings". In this scenario the interest rates were the same and it is not a problem.

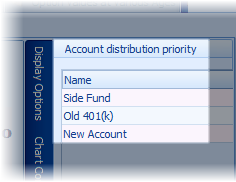

4.In the Retirement Years chart, see when the new account's balance is distributed. If it is before the client's Old 401(k) account (which is earning a lower rate of return during retirement), this can result in a significant shortfall. To change the distribution order, click on one of the bars in the Retirement Years chart, and on the right hand side, under "Account Distribution Priority", drag-and-drop the new account under the Old 401(k) account.

5.This also may be effected if the new account's Distribution Method was something other than Use Funds as Needed.

1 While this illustration was setup so that it can be run at any time (stating the client's age rather than their date of birth) because of the day of the month and when the raise occurs differ a little bit each time this is run, the values will differ slightly from what is illustrated, and approximate language is used when stating values.