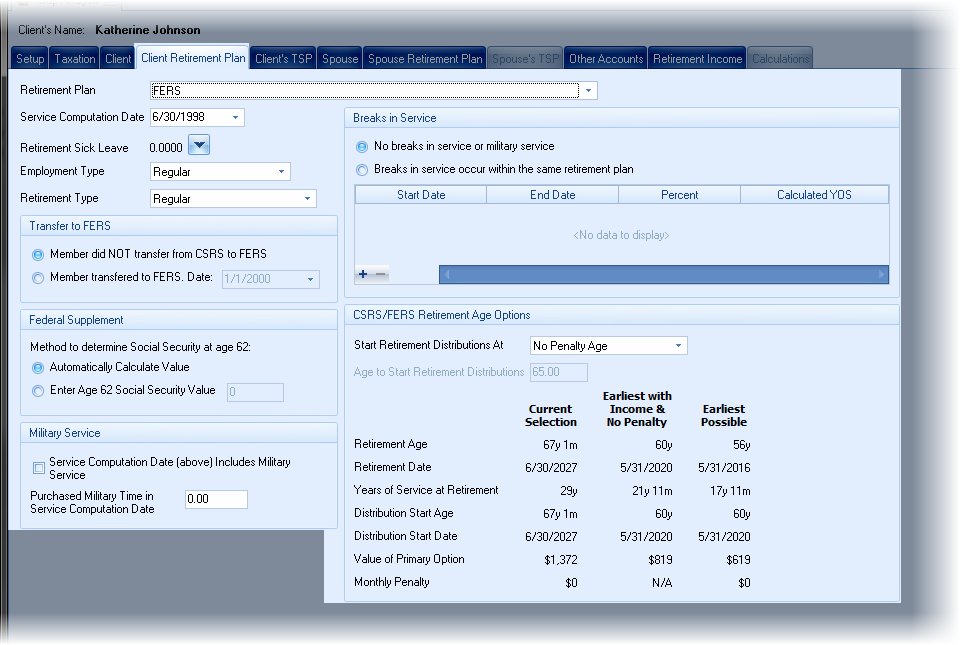

Selecting the FERS, CSRS, or CSRS with Offset retirement plan reconfigures the Retirement Plan tab for data input related to the specific plan.

The prompts for this screen (and the CSRS input screen) are discussed below:

Service Computation Date

Enter the retirement service computation date (SCD) the participant entered the plan. The SCD may not be the date of employment.

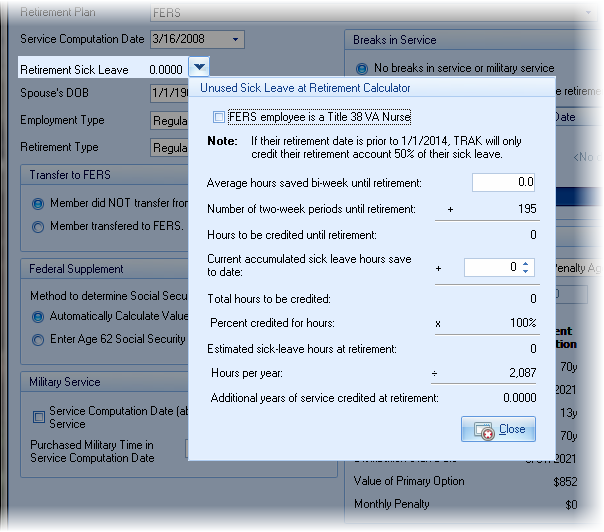

Retirement Sick Leave

Retirement sick leave can be calculated by clicking on the drop-down button to the right of the Retirement Sick Leave value.

Fill in the data as required to calculate the additional years of service. Press the Close button when finished.

Spouse DOB

This prompt will appear if the Setup tab is configured not to include the spouse. Enter the spouse DOB. This value may be cleared, in which case survivor benefit options will not be displayed.

Select the type of federal employee the participant is from the list of Regular, Firefighter, Law Enforcement, Air Traffic Control and Customs and Border Patrol.

Select the type of retirement the participant is involved in from Regular, Optional-Government Offer, and Optional-Personal Election.

Transfer to FERS (FERS retirement plan only)

If the participant transferred from CSRS to FERS, select the appropriate item and enter the transfer date.

Federal Supplement

If the participant is retiring prior to age 62 and is eligible for the Federal Supplement, it will automatically be included. (If they are retiring prior to age 62 and are not eligible for the Federal Supplement, a note will be displayed below the option grid indicating why they are not eligible).

The Federal Supplement is calculated based on the Social Security income at age 62. TRAK can calculate this value, but the best method to get a correct Federal Supplement value is to enter the correct age 62 benefit from Social Security benefit.

Supplement has Annual COLA

In very specific situations, the Federal Supplement has a COLA. If the individual qualifies for the COLA, check this box.

Military Service

If the participant has military service, select the method for entering the service.

| Note: | TRAK assumes the military service occurs after 12/31/1956. |

Service Computation Date (above) includes Military Service

If the SCD includes military service (either purchased or un-purchased), check this box.

Unpurchased Military Time in Service Computation Date

This prompt will display only if the previous check box (Service Computation Date (above) includes Military Service) is checked. Enter the military time (in years) included in the SCD.

Purchased Military Time in Service Computation Date

Enter the purchased military time (in years) included in the SCD.

Member will have 40 quarters in Social Security by age 62 (CSRS Only)

If the participant will have 40 quarters of Social Security, check this box.

Divorce Reduction Method

This allows for configuring a reduction to the pension due to a divorce. The options are:

None: No reduction occurs.

Percent: The method for reducing the pension is by a percentage. A new Percent Reduction prompt will be displayed. Enter the percent the pension is to be reduced. For example, a 25% reduction for a $1,000 benefit would result in a $750 payment for the client.

Dollars per Month: Enter the monthly dollar value to reduce the annuity for the client. A new Monthly Dollar Reduction prompt will be displayed. Enter the monthly reduction to the annuity.

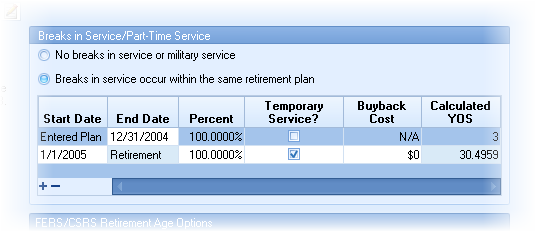

Breaks in Service/Part-Time Service

This includes breaks in service, part time service, and temporary service.

| Note: | For federal plans, breaks-in-service and part-time service should always be future. Prior breaks and part-time work are accounted for in the Service Computation Date. |

To add a line, click on the add button found at the bottom left of the grid.

Add an entry for each break in service. Note: the blue columns are read only columns and may not be edited.

If the buy back cost for the temporary service is known, enter the value in the respective column. TRAK will be able to calculate the current cost for the buy back from the historic interest rate.

CSRS/FERS Retirement Age Options

TRAK provides the ability to defer they payments after date of separation. Three options are available:

1.No Penalty Age: If the client's retirement date would incur a penalty, the pension payments will be deferred until no penalty would occur.

2.Earliest Possible: Start payments as soon after retirement as possible, regardless of any penalty.

3.Specific Age: Manually enter the age to start payments. The age cannot be later than 62.

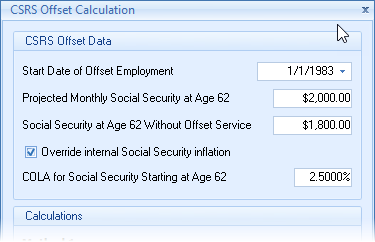

CSRS Offset Values

When working with CSRS Offset, specific values need to be entered to calculate the offset.

Most of the inputs are self explanatory. The value for "Social Security at age 62 Without Offset Service" is not a value that can be obtained from the Social Security Administration (SSA). (The federal Office of Personnel Management contacts SSA directly to obtain the value when the employee turns 62) .Therefore, if the value is unknown, a conservative value should be used. The lower the value, the more it impacts the offset. Therefore a value of zero could be used for the most conservative impact.