Bucket Strategy Tab

TRAK’s Gap Analysis program now has a new feature called the Bucket Strategy (a.k.a. retirement income allocations). Typically this is where account assets are, at retirement, used to purchase up to 5 products or income allocation accounts that will guarantee income and potentially minimize market fluctuations. Each allocation represents a bucket or pot of money with a time frame for its use. The first bucket is typically designated for years 1-5, the second for years 5-15, and the third bucket for 15+ years. In general, say the first few years of retirement is in more cash based accounts (allocation 1) and for years say 3-10, a little more risk in accounts such as bonds, bond funds, etc. Then, for later in retirement, say allocation 3, you invest in more risk like stocks in a globally diversified stock portfolio, etc.

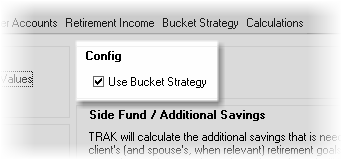

Setup

On the “Setup” tab in Gap Analysis, check the box in the “Config” box “Use Bucket Strategy”. This will add a tab between the “Retirement Income” and “Calculations” tabs. Now, clicking on the “Bucket Strategy” tab will provide access to this feature.

After clicking on the "Bucket Strategy" tab, by default, the editor is initially locked. Click on the box “Allow Recalculation of Buckets” to create or edit existing allocations which allows TRAK to recalculate as data is entered or modified.

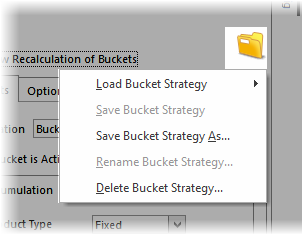

Saving and Loading Bucket Strategies

Setting up a Bucket Strategy can take a bit of time, but after a strategy has been created, it can be saved and loaded with another client. The file menu to the right of the Allow Recalculation of Buckets allows for saving and loading of bucket strategies.

| Notes: | This button is disabled if there Allow Recalculations of Buckets is not checked or if there are no current Bucket Strategies saved and there are no buckets for the current client. |

| If the button is enabled, pressing Alt-B will activate this menu. (Now aren't you glad you read the the user manual?) |

Each menu option is briefly discussed below.

Load Bucket Strategy

This is enabled if there are any saved Bucket Strategies. Click on the previously saved Bucket Strategy to load it.

Save Bucket Strategy

This is available if the current Bucket Strategy has been loaded or saved (using Save Bucket Strategy As... this option is available). This will save the current configuration for the the Bucket Strategy.

Save Bucket Strategy As...

This is enabled if there are any buckets with the current data. This allows saving the current strategy.

Rename Bucket Strategy

This is available if the current Bucket Strategy has been loaded or saved (using Save Bucket Strategy As... this option is available). This allows renaming the current Bucket Strategy.

Delete Bucket Strategy...

This is enabled if there are any saved Bucket Strategies. This will allow deleting any bucket strategies.

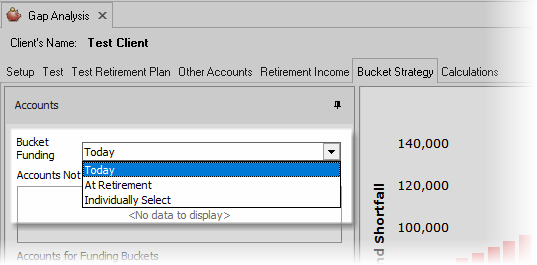

Configuring a Bucket Strategy

First, choose when to “Allocate Funding” by selecting one of 3 options (found on the left side):

1. At Retirement (most common) – this will take the sum of the accounts’ balances and purchase the allocations at retirement.

2. Today – this would use the accounts to purchase allocations at the current date. Note that not all accounts are available for reinvestment into allocations prior to retirement.

3. Individually Select – this allow each account to be configured for when available for funding allocations.

Additionally, if there are accounts not to be used for funding buckets, drag and drop those accounts into the box “Accounts Not Used to Fund Buckets” Accounts that are included for funding allocations can be reordered.

Up to 5 buckets can be configured. Each bucket or allocation has a shortfall to address for the given time frame number of years.

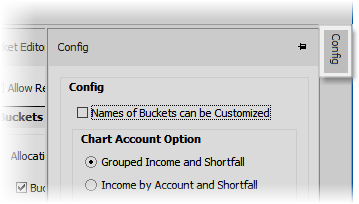

Note: The graph above shows a shortfall. The shortfall is due to the fact that all the accounts for funding buckets are pooled together to purchase the buckets and each one will handle a portion of the shortfall. The shortfall amount is effected by the income replacement ratio, the COLA and special retirement expenses, etc. Accounts such as defined benefit or social security are not available for bucket strategy illustrations so only the cash balance accounts are included for funding buckets. To configure how the chart looks, click on the far right vertical tab “Config” and make selections on what is visible, how the chart displays values and even assign names to each bucket.

APPSHORTNAME%> calculates the amount of money needed to fund each bucket with those values factored in. Each bucket or allocation represents flex income account funds to be drawn from when needed. These accounts can be things like CDs, IRAs, etc.

If illustrating a fixed income product such as fixed, variable or indexed annuities for a bucket, the flex money will be utilized to address shortfalls above the fixed income annuity product.

If enabled, in addition to the distribution rate of return for fixed products, a flex rate of return is available. To set a flex account rate of return over all buckets, that feature is located on Options tab of the Bucket Editor right window pane.

Adding Buckets

To add a bucket, click on the green “+” icon.

In this first bucket (e.g. Bucket #1), there may be no accumulation period. This is due to the fact that it is funded and starts at retirement.

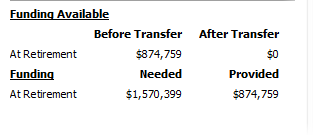

If the bucket is for a period of 5 years, the shortfall amount for those years will be calculated and the amount will be used from the “Funding Available” leaving an amount “After Transfer” of the balance.

If the bucket has time for accumulation (e.g. "Bucket #2"), set the desired values for the "Product Type", the "Rate of Return" and any "Annual Fee %" applicable. Calculations will be generated from the values entered.

Next, click on the “Distribution” tab to configure the years of distribution (e.g. 5) and decide whether or not to use “Fixed Account in Distribution”. If checked, choose the “Product Type” (either Fixed, Indexed or IRA), and “Fixed Act. Rate of Return” and any “Fixed Act. Annual Fee (%)” if applicable. As with the accumulation tab, the calculations will reflect the values entered.

Additionally, clicking on the “Options” tab will allow further configuration such as the “Retirement Years Method” (12 month periods or calendar years), the “Account Types” (all qualified or pre-tax, all non-qualified or after-tax, or, mixed) and locking in “Distribution Options” with either a “Rates of Returns Method for CDs/IRAs and “Same for All” or “Customized for Each”.

Note: Adding buckets allows for accumulation configuration. If the first allocation is for 5 years funded at retirement, the second will have 5 years to accumulate before distribution occurs, etc.

For further configuration, the far right vertical “Config” menu allows the ability to name each allocation via a custom label and chart configurations and what the chart illustrates. Finally, to change the data entry for allocations into a separate tab for accumulation and distribution, select that option from the drop down list next to “Accumulation & Distribution Editors Display”.

Note: Taking the retirement funds and re-investing at retirement can not only help navigate market fluctuations but can also create more wealth generating opportunities beyond the first few years of retirement using accumulation rates of return for future buckets.

FAQs:

Flex accounts in conjunction w/ fixed - TRAK will calculate (under the hood) scenarios with fixed allocations with some flex income values to account for COLAs. It is extra income generated from over-funding the fixed annuity piece (flex in a fixed). TRAK finds the least cost scenario to allow for fluctuations with inflation. This provides a level of flexibility inside a fixed bucket strategy.

Intended only for cash balance accounts – not SS, pensions, etc. You can reorder the accounts and change when they are funded together or individually.

Note: Tax Wise cannot be enabled to utilize the ‘bucket strategy’ feature at this time.