Federal 1040 Input

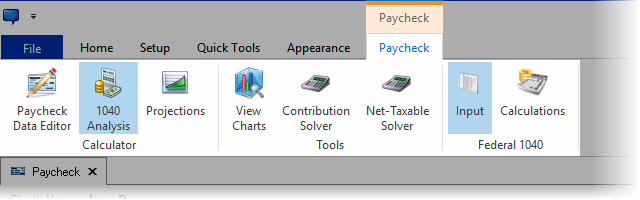

The 1040 Analysis is available in TRAK's Paycheck calculator. After the Paycheck calculator is opened, click on the 1040 Analysis button found on the Paycheck context tab on the ribbon bar.

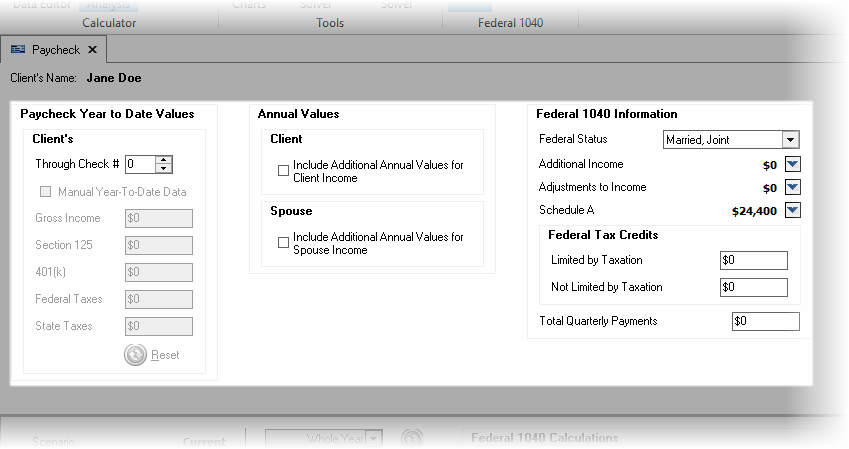

The screen will appear similar to what is shown below.

The input for the Paycheck 1040 window is discussed below:

Paycheck Year-to-Date Information

Year-to-date information allows for manual data entry for income and contributions made year-to-date. TRAK makes its best attempt, based on the data entered, to calculate the correct values. However, changes in income or contribution values may have a significant effect on projections, especially later in the calendar year.

Client's and Spouse's Year-to-Date Values

| Note: | The box for the spouse's year-to-date values is only displayed if a spouse's paycheck was created for the Paycheck Calculator. |

Through Check #

Enter the last check number that has been paid. TRAK automatically calculates taxes withheld so far based on the information entered. TRAK makes calculations to change the withholding allowances both for the remainder of this year and for whole year purposes.

Manual Year-To-Date Data

If the calculated year-to-date data does not match that listed on the paycheck (shown in gray), check the Manual Year-To-Date check-box. This allows the exact values to be entered directly from the paycheck stub.

| Notes: | The accuracy of the year-to-date values may significantly affect the accuracy of the 1040 projections for this year. If year-to-date values are manually entered, the program does not have to make assumptions about the values. |

| There will be year-to-date values for the spouse if a spouse's paycheck was created in the Paycheck Calculator. |

Year-to-date prompts

The prompts will be enabled if the Manual Year-To-Date Data check box is checked. The list of prompts will depend upon the configuration of the Employer File Visible Fields tab.

Reset button

This button will restore the values to the calculated values.

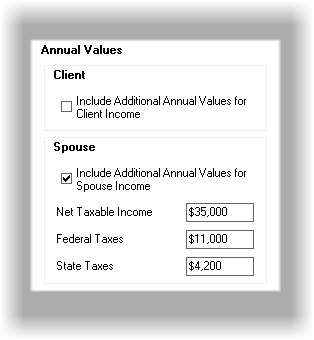

Annual Values

If the client (or spouse) has income outside of the illustrated paycheck, or if the spouse's paycheck was not entered in in the Paycheck section, the values can be entered in "Annual Values" data entry section.

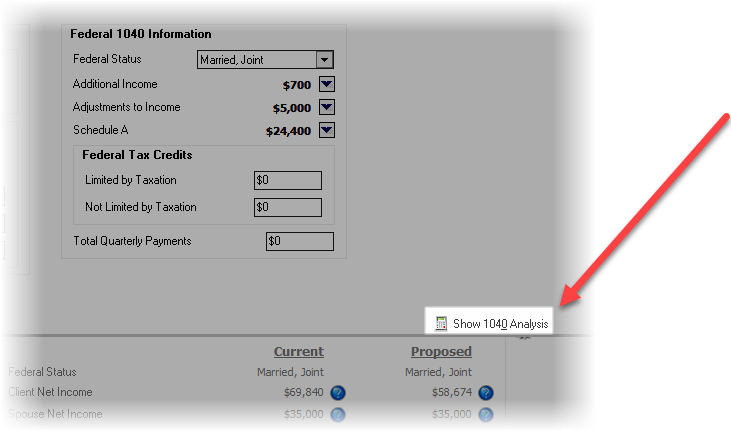

Federal 1040 Information

This section allows data entry of 1040 tax information.

| Note: | Having the client's prior year 1040 tax return will help in the accuracy of calculating this year's federal values. Also, asking the client if they expect to have any significant changes in their taxes this year will provide a more accurate calculation. |

The prompts are discussed below:

Filing Status

Select the federal 1040 filing status.

Federal Exemptions

Enter the number of exemptions the client will claim on their federal 1040 this year.

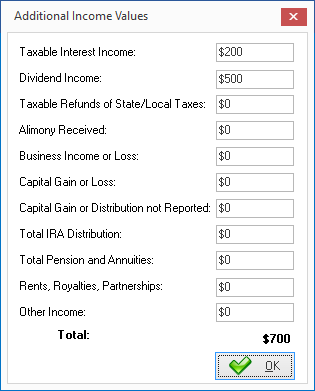

Additional Income

Accessed by clicking on the calculator button to the right of the value.

Enter the values according to the prompt.

Selling Opportunity: If values are entered for the Taxable Interest Income and Dividend Income, there may be an opportunity to help clients better invest their monies.

| Notes: | Be sure to include business income from part time work in the home (e.g. child care) where taxes were not withheld. |

| Business Income is subject to additional FICA taxes. TRAK computes the Self Employment Tax value and adds it to the tax due amount. |

Adjustments to Income

Accessed by clicking on the calculator button to the right of the value. Enter the values as required.

Schedule A

Accessed by clicking on the calculator button to the right of the value.

Enter the values as indicated.

| Notes: | TRAK automatically displays the standard deduction for the Filing Status previously selected. |

| If the client files the 1040 short form, there is no need to enter the data for the Schedule A values. |

| Because TRAK changes the state allowances, it will calculate the value for the state and local income taxes. The value will be displayed in the 1040 calculations. |

Tax Credit

There are two types of tax credits: one limited by taxation (nonrefundable tax credit), the other not limited by taxation (refundable tax credits). Enter the values accordingly. For more information visit www.1040.com/tax-guide/tax-terms/tax-credit. (We do not make any guarantees to the accuracy of the information provided on third party website).

Total Quarterly Payments

Enter the total quarterly federal tax payments that will be made.

| Note: | The 1040 Analysis values are shown below the input fields. The values are updated as data is changed on the input fields. |

To focus on the 1040 Analysis click on the Show 1040 Calculations button found below the input

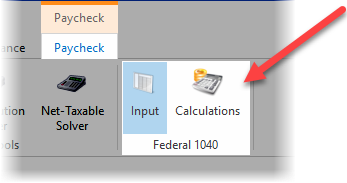

or the click on the Calculations button in Paycheck ribbon bar.