TRAK Solutions

Pension Maximization

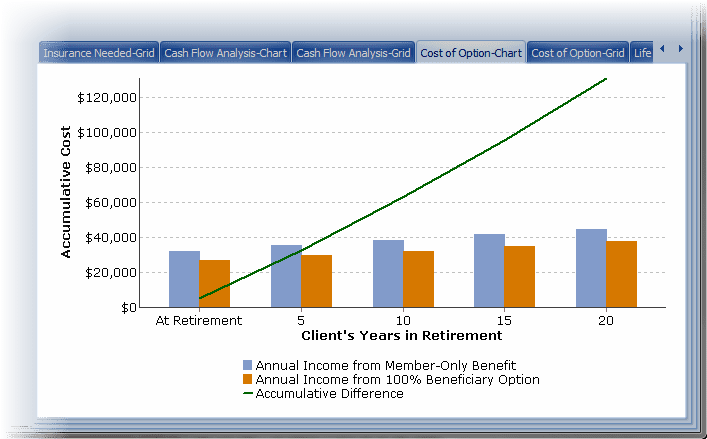

TRAK includes two Pension Maximization (also known as Pension Income Maximization) calculators that easily illustrate for a client the option of replacing a lower income option with life insurance. Show the income a client will receive from the various options in a retirement pension plan, the projected cost over retirement of taking a lower income option, and how life insurance may provide the income needed for his or her spouse. All of this can be done with a few data entry points and the click of a mouse!

The Pension Max calculators can illustrate many options for a client:

- Instantly show the lifetime cost of taking the alternative option with the higher spouse income.

- Easily calculate the life insurance needed for any of the lower income options by choosing among the hundreds of defined benefit plans included in TRAK.

- Calculations can include either a single whole life policy or a number of term policies and a whole life policy (the latter to reduce the cost of the life insurance).

- Illustrate the cash flow analysis in an annotated grid and a chart.

- Quickly calculate the insurance coverage needed and provide your client with a report illustrating the concept.

With over 700+ state defined benefit pension plans in TRAK for state defined benefit plans, calculating a Pension Maximization illustration has never been easier!