ESOP

This allows for configuring an Employee Stock Option Plan (ESOP) associated with the employer's retirement plan.

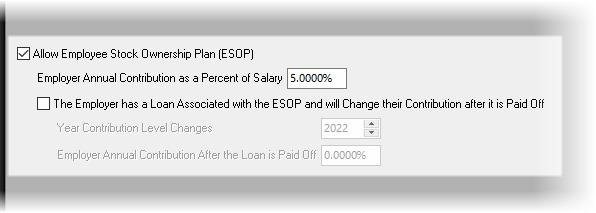

Allow Employee Stock Option Plan

Check this box to allow the ESOP for the 401(k). (The client's account, including current balance, can be configured in the "Other Accounts" tab in the Quick Gap and Gap Analysis calculators).

Employer Annual Contribution as a Percent of Salary

Enter the employer's contribution to the ESOP as a percent of the employee's annual salary. TRAK makes the employer's contribution on the last paycheck of the calendar year.

The Employer has a Loan Associated with the ESOP and will Change their Contribution after it is Paid Off

If the employer has a loan associated with the ESOP that, when it is paid off, the employer contribution level will change, check this box.

Year Contribution Level Changes

Enter the year the contribution level changes. This may be the year after the loan is paid off.

Employer Annual Contribution After the Loan is Paid Off

Enter the employer contribution level after the loan is paid off.