Employer Contributions

This tab will allow for configuring various employer contributions options, including matching employee pre-tax contributions.

The prompts for each group are discussed below.

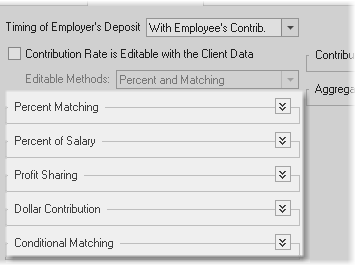

Percent Matching

Percent of Employee Contribution

Enter the percent of the employees contribution that the employer will match.

Maximum Percent of Salary

Enter the maximum percent that the employer will match.

Maximum Dollar per Paycheck

If applicable, enter the maximum dollar per paycheck the employer will contribute to the retirement plan. If there is no maximum dollar limit, leave the value as zero ("$0.00").

Percent of Salary

Percent of Salary

Enter the percent the employer contributes, regardless of the employee contributions.

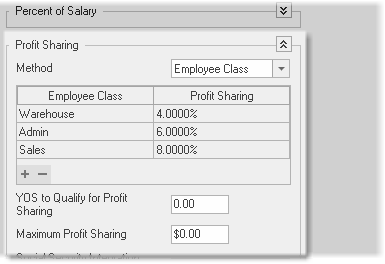

Profit Sharing

Method

There are three options to select from: None (no profit sharing), Flat Rate (the same rate for all participants in the plan) and Employee Class (profit sharing is allocated differently to different classes of employees). If None is selected, no other profit sharing prompts will be visible.

End of Year Profit Sharing (Percent of Salary)

This prompt is visible if Flat Rate is selected in the Profit Sharing Method prompt. Enter the end of year profit sharing for the employer contributes to the retirement plan participants. (To add a record, tab through the last line or press the Insert button. Note that new records are not saved until a change has been made to the data. To delete a record, press Control-Delete).

Employee Class and Profit Sharing

The employee class grid is displayed when Employee Class is selected in the Profit Sharing Method prompt. Enter a record for each class of employee with their corresponding profit sharing percent.

Maximum Profit Sharing

If applicable, enter the maximum dollar value of the employer's profit sharing. If the employer does not have a maximum value, leave the value as zero ("$0.00").

Social Security Integration Option

This allows for additional profit sharing above the Social Security Wage Base (SSWB). The options are:

None: Profit sharing does not take the SSWB into account.

Double (up to 5.7%): Profit sharing doubles for income above the SSWB.

Custom: Allows for a custom increase in the profit sharing for income above the SSWB (but the increase is limited to 5.7%).

Additional Match Above Social Security Wage Base

Enter the custom additional profit sharing percent above the SSWB.

Dollar Contribution

Use this option if the employer contributes a specific dollar amount on a per-paycheck, monthly, quarterly or annual basis.

Frequency of Contribution

Select the frequency of the employer dollar contribution to the retirement plan.

Conditional Contribution

The Conditional Contribution method allows for the employer to contribute a specific percent to the retirement plan if a participant's contribution reaches a certain threshold.

For example, if the employer will contribute 4% and the employee contributes 3%, enter 3% for the Minimum Employee Contribution and 4% for the Employer Contribution.

Minimum Employee Contribution

Enter the minimum participant's contribution required to received the employer's contribution.

Employer Contribution (Percent of Pay)

Enter the employer contribution to the retirement plan (as a percent of pay) if the participant reaches the Minimum Employee Contribution threshold.

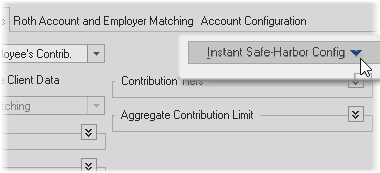

Instant Safe Harbor

Instant Safe Harbor button

This button brings up a pop-up menu that allows for quickly configuring the contribution options to a Safe Harbor option.

When an item is clicked, contribution options not associated with the Safe Harbor option will be cleared.

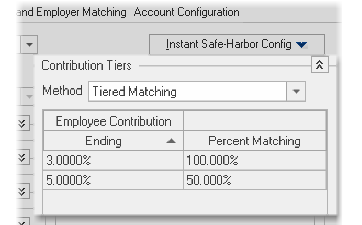

Contribution Tiers

Tiered Method

TRAK allows for various methods of tiered matching:

Salary

Employer contribution is dependent upon the salary of the client. For example, the employer may contribute 5% of the first $20,000, and 2.5% until the income is $50,000.

Age

Use this method when the employer contributions are dependent upon the employee's age.

YOS

Use this method when the employer contributions are dependent upon the employee's years of service with the employer.

Tiered Matching

Use this method when the employer contributions are dependent upon the employee's contribution, but is tiered.

Years of Service Percent Matching

This allows for the employer's matching to be based on the participant's years of service.

| For Example: | If an employer contributes 100% of the first 3%, and 50% of the next 2%, the grid should appear similar to what is shown in the table below (also similar to the screen shot above). |

Percent of Income |

Percent Matching |

3% |

100% |

50% |

50% |

Use this method when the employer matches a percentage of the employee's contribution in tiers (e.g. 50% of the first 3% and 25% of the next 3%) and the tiers are tied to the number of years of service the employee has.

| Note: | If a matching system other than those listed is encountered, and you would like to see it added to TRAK, send an e-mail to Support@retireready.com. Include information about the method, and the TRAK program team will prioritize efforts to incorporate it into a future build. (Obviously, there are no guarantees, as the complexity of the matching will determine the reality of inclusion and time tables for such.) |

True Up

Plan Provides an Employer End-of-Year True Up Contribution

Check this box if the plan provides an end-of-the year true up contribution. If the employer provides a contribution other than the matching, the additional contribution will be included when determining if a true up contribution needs to be made. (Click here for an example of a true up contribution).

| Note: | The true up calculations does not work with employer matching tiers based on years of service. |

Aggregate Contribution Limit

The aggregate limit (expressed as a percent of paycheck) provides the ability to cap the employers total contribution to the pre-tax plan. This includes all contributions made by the employer except (pre-tax matching, Roth matching, percent of salary, etc.) end of year profit sharing. It is only displayed if, on the "Roth Account..." tab the Roth Account is included and the matching is not integrated with the pre-tax account.