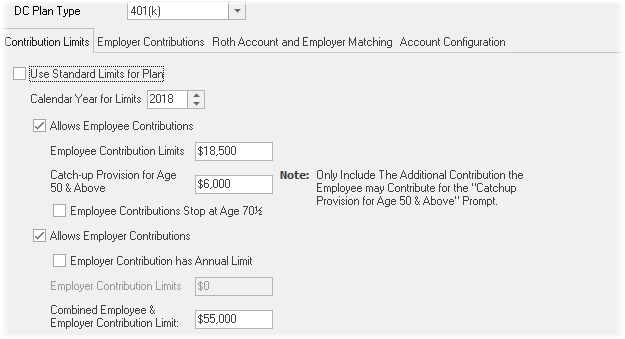

Contribution Limits

By default, the limits will be set by selecting the DC type in the header part of the dialog. The limits are indexed by inflation in $500 increments.

Use Standard Limits for Plan

If custom limits are needed (e.g. the employer limits their own contributions less than the regulations), uncheck the Use Standard Limits for Plan and enter the custom contribution limits for the plan.

Calendar Year for Limits

Future contribution limits are indexed by inflation in $500 increments starting on the calendar year.

Allow Employee Contributions

Check this box if employee contributions are allowed. (While most plans allow for employee contributions, a few, such as SEP retirement plans, do not).

Employee Contribution Limits

Enter the annual employee contribution limit for the retirement plan.

Catch-up Provision for Age 50 & Above

If the plan has a catch up provision allowing for employee contributions to increase at age 50, enter the additional contribution value.

Allows Employer Contributions

If the plan allows employer contributions, check this box. (IRA and Simple IRA plans do not allow employer contributions).

Employer Contribution has Annual Limit

Enter the annual employer contribution limit.

Combined Employee & Employer Contribution Limit

Enter the annual contribution limit for both employee and employer contributions.