Annuity Products

The Annuity Products editor allows for entering rates for annuity products. These products are used with the Pension Max calculator. The product may be selected in the Pension Max when Annuity Product is selected for Payout Method.

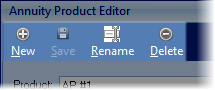

The Annuity Products toolbar (shown below) buttons (New, Save, Rename, and Delete) each performing their respective action with an Annuity Product editor.

Each prompt in the editor is discussed below

Product

This will allow selecting between the already created annuity products.

Con fig Tab

Payout Method

This configures how the annuity pays out, either Guaranteed Term and Life or Life Only.

# of Payout Years

If the Payout Method is Guaranteed Term and Life, enter the number of years of guaranteed payments.

Age Range

Starting Age

Enter the starting age for the annuity payout factors.

Age Step

Enter the step in age for the annuity payout factors to be entered. For example, if the Starting Age is 50, and the Age Step is 5, the ages to enter factors for would be 50, 55, 60, etc.

Ending Age

Enter the top age for the annuity payout factors.

Number of Decimals

Enter the number of decimals (between 1 and 4) used in the annuity factors.

Gender Method

If the annuity product has different tables for male and females, select Gender Specific otherwise select Unisex/Gender Neutral.

Interpolate Method

Select the method to interpolate the annuity factors. For example, if the Age Step is 5, but there are factors for each year between the steps, select Annually. If the annuity factors interpolate more often then annually, select the appropriate frequency. If no interpolation occurs, select None.

Annuity Factor Method

TRAK's Annuity Products supports two different payout methods:

Percent per Year: The annuity factors are a percentage of the account's balance at initial distribution. For example, an 6.5% annuity factor with an $120,000 account balance would pay out $7,800 annually or $650 per month.

Monthly Dollar per Thousand: The annuity factors are a dollar value per thousand dollars of the account, and is paid out per month. For example, a $5 annuity factor with a $100,000 account would payout $500 per month (e.g. comparable to a 65 Percent per Year factor).

Factors

The factors are entered in one more more tables, each associated with a minimum initial premium. The rows (associated with ages) and columns (either genders specific or gender neutral) allow for entering the specific factors. The table associated with each minimum is configured by the data entry on the previous tab.

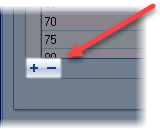

To add a minimum table, press the "+" button located at the bottom of the table. Similarly, to remove a minimum table, select the respective table and press the corresponding "-" button.

The table expects the annuity factors to be greater then zero and not decrease as the age increases. If the value is zero, or if the factor is less than the previous factor, respective values are displayed in a bold red font.