Each of the features prompts for the Roth Conversion data entry are discussed below

Quick Config

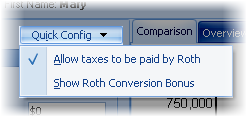

The Quick Config button found above the editors allows for configuring the options in the Roth Conversion program.

By default these two options are turned off. This reduces the number of prompts on the screen.

Personal

Client's date of birth

This is used for calculating any RMDs from the IRA account.

Roth Conversion Options

Amount for Roth conversion

Enter the value of the pre-tax qualified plan. If the client is required to take a RMD this year and has yet to take the distribution, reduce the account value by this value.

Non-deductible IRA balance

Enter the non-deductible balance (non-taxable balance) of the IRA account.

Number of years until distribution

Enter the number of years until distribution of the funds, i.e. number of years to run the illustration.

Roth conversion bonus

Enter the bonus value for the Roth account.

Note: This is available if the "Show Roth Conversion Bonus" option is checked in the Quick Config option above.

Federal and State Marginal Tax Bracket

Taxes paid by

Select if the taxes are to be paid by a Non-qualified account or from an IRA Account Distribution.

| Note: | This prompt and the next prompt are only available if the "Allow taxes to be paid by Roth" option is checked in the Quick Config option above. |

Account owners is at least 59½ at conversion and is not subject to a 10% penalty.

Check this box if the client is not subject to a 10% for pre-59½ distribution.

This prompt is only enabled if the taxes for distribution are being paid by the IRA Account distribution.

Client's federal adjusted gross income (AGI) for tax year is known

If the client's adjusted gross income is known for the conversion year, check this box.

| Hint: | A Roth conversion may increase a client's marginal tax bracket from their current bracket into a higher bracket. If the client's AGI is known, the software will automatically calculate the taxes in the higher bracket(s). |

| Note: | The next two prompts are only enable if the Client's federal adjusted gross income (AGI) for tax year is known prompt is checked. |

Federal tax table

Select the federal tax table for the client.

Current calendar year adjusted gross income (AGI)

Marginal state tax bracket

Enter the marginal state tax bracket for conversion. Note that if the state uses a progressive tax table, a conversion may push a client into a higher tax bracket. This must be considered when entering the Marginal State Tax Bracket.

Federal and state marginal tax bracket for conversion

If the Client's federal adjusted gross income (AGI) for tax year is not checked, this prompt will be enabled. Enter the combined average marginal federal and state tax bracket for a Roth conversion. Note that a conversion may increase a client's immediate tax bracket, and this should be taken into consideration.

Marginal federal and state tax bracket for distribution

Enter the combined marginal federal and state tax bracket at distribution. This is used for comparing the future Roth account balance with the future IRA after-tax balance. Note that in the case of an IRA account, the distribution may be made over any number of years and may not increase the client's marginal tax bracket.

Rates of Return

Qualified plan rate of return

Enter the rate of return for pre-tax plan.

Roth IRA rate of return

Enter the rate of return for the Roth IRA. Normally this would be similar to the qualified plan rate of return.

Non-qualified after-tax rate of return

Enter the rate of return of the non-qualified after-tax account. This is often significantly less than a qualified plan.