Overview

The Overview screen provides a quick overview of the calculations for the client or spouse.

The overview screen can be divided into two areas: the top, which shows calculated values relating to the client or spouse, and the bottom, the appearance of which will change depending upon the type of retirement plan selected (defined contribution or defined benefit). Each is discussed below:

Top of the Overview Calculation Screen

The top of the overview screen shows calculations relating to the client's age, work history, and other information.

| Hint: | The values should be checked for accuracy before moving on to other screens--if the values appear incorrect, confirm that the data has been entered correctly. |

Months to Wait Before Starting Savings

The calculator will estimate the savings shortfall (retirement gap) of the client, based on their projected sources of income and their needs. The savings needed assumes that the client begins saving today. This prompt determines the number of months before increased deferrals are made to estimate the cost of waiting.

Spouse's Values

In the "Retirement" column, the "Spouse" value's are at the client's retirement, not at the spouse's retirement.

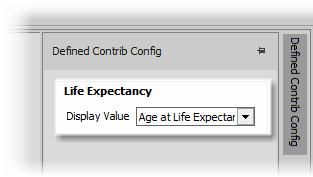

Config

This panel is available when a defined contribution plan is selected for the active person (client or spouse). It can be opened by clicking on the Config tab on the right-top side of the Overview calculation window. Configurations for both "Life Expectancy Display Value" and "Additional Savings Frequency" can be configured here.

Life Expectancy Display Value

For both defined benefit and defined contribution illustrations, clicking on the horizontal configuration tab on the far right of the screen will allow changing the display value between "Age of Life Expectancy" and "Number of Years".

Additional Savings Frequency

This option allows for additional savings needed to be set for "Monthly" or "Per Paycheck".

Lower Section of the Overview Calculation Screen

The lower part of the calculation tab changes based on the type of retirement plan that is selected. Click on the links below for help with each item: