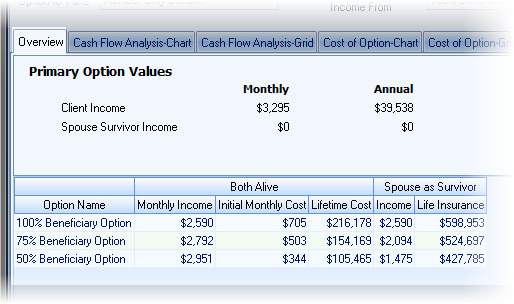

The Overview tab displays the income both monthly and annual from the selected option at the top (for both the client and the spouse) and also displays the options that provide lower client income levels below.

The grid displays the life insurance needed to replace the spouse's income for each of the alternative options.

The grid's columns are discussed below:

Option Name

The option name from the plan document.

Both Alive

Monthly Income

The monthly income of the option at retirement.

Initial Monthly Cost of Option

The monthly cost at retirement of taking the alternative option.

Life Cost

The life time cost of taking the option, including the cost of living adjustment in the retirement plan.

Spouse

Income

The monthly income of the option at retirement if the client is deceased.

Life Insurance Needed

The life insurance needed is the value required to provide the spouse with the monthly income the defined benefit plan's option would have provided the spouse as a survivor.