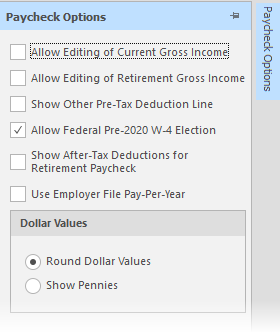

Paycheck Configuration Options

Paycheck Configuration options are is available using "Paycheck Options" dock panel on the far-right of the screen.

Allow Editing of Current Gross Income

By default, the Paycheck Comparison tool will use the income entered for client and spouse. Check this box to override this value.

Allow Editing of Retirement Gross Income

By default, the Paycheck Comparison tool calculate the Retirement Gross Income in today's dollar values using the data entered for the client (or spouse). Check this box to override the calculated value.

Show Other Pre-Tax Deduction Line

Check this box to add a "Other Pre-Tax Deduction" to the paycheck.

Allow Federal Pre-2020 W-4 Election

In 2020 the federal withholding options changed. To allow for pre-2020 election option, check this box. (

Show After-Tax Deductions for Retirement Paycheck

By default, after-tax deductions are not available for the Retirement Paycheck. It can be available by checking this box.

Use Employer File Pay-Per-year

By default, the Paycheck Comparison tool will use the paychecks per year from the client's and spouse's data entry fields. Check this box to use the value from the Employer File.

Use Percentages for Federal and State Withholding Taxes

Often the election for distributions from retirement account is a percentage of the distribution. If this is not checked, the federal W-4 fields, and corresponding state values, are used.

For Contribution Comparison include Spouse's Paycheck

When comparing contribution values, by default the spouse's paycheck is not displayed. Check this box to include the spouse's paycheck.

Dollar Values

Select "Show Pennies" to display dollar values with pennies, otherwise TRAK will display rounded values.