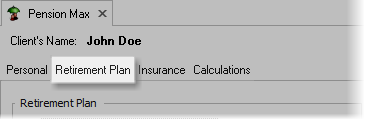

Data Entry

For the Pension Max tool, there are 3 tabs for data entry (Personal, Retirement Plan and Insurance) and a Calculations tab. The data entry prompts are detailed below.

| Note: | If there is an error in the data entry, the calculation tab will be disabled. |

| If this is the case, then a "View Error Message(s)" button will appear at the top-right of the data input. Clicking on the button will display the error messages. |

Personal

Date of Birth

Enter the client's date of birth.

Retirement Age

Enter the age the client anticipates retiring.

Retirement Month

Select the month in which the client expects to retire. The retirement date will be the end of the month following the date they turn their retirement age.

| Example: | If a client is born on 2/15/1960 and plans to retire at age 60, their 60th birthday would be 2/15/2020. If February is selected as the Month to Retire, then the retirement date would be shortly after turning 60 (2/29/2020). If January is selected as the retirement month, then their retirement date would fall in the following year (1/31/2021). |

Client's Life Expectancy Method

There are four methods to calculate life expectancy of the client (or spouse) at retirement. They are:

1.IRS Tables

This is the life expectancy of the client at retirement. (If the retirement age changes, the life expectancy date of the client will also change.)

2.IRS Tables plus Years

This is the same as IRS Tables plus a number of years. Enter the number of years to add to the IRS life expectancy.

3.Specified Age

Enter the age of the life expectancy of the client.

4.Percentile

Allows entering the percentile of life expectancy the client will live to. For example, a value of "90" for percentile would indicate that at retirement they expect to outlive 90 percent of the population.

| Note: | Be aware that the first two methods (IRS Tables and IRS Tables plus Years) are relative to the person's retirement age. This means that with different retirement ages, the life expectancy will be recalculated. (The software recalculates it at retirement because it is assumed they will reach retirement age. To calculate it prior to retirement could significantly reduce a persons retirement years thereby reducing the amount they need to save). |

Spouse's DOB

Enter the spouse's date of birth.

Spouse's Life Expectancy Method

Select the life expectancy method for the spouse (see the explanation above for the Client's Life Expectancy Method).

Income per Pay Period

Enter the gross income per pay period for the client.

Pay per Year

Enter the number of paychecks the client receives per year.

Annual Raise

Enter the projected annual raise for the client.

Retirement Top-Marginal Tax Bracket

Enter the top marginal tax rate in retirement.

| Note: | This is used to compare the after-tax income from the pension plan to the after-tax income from the life insurance proceeds. Because the life insurance is not taxable, |

Inflation

Enter the anticipated inflation rate or annual cost of living adjustment (COLA) during retirement.

| Note: | This may or may not affect the illustration. The pension plans in TRAK have their COLA configured per the plan document. Some plans are sensitive to COLA, while other plans are not affected by COLA. |

Retirement Plan

Calculate Pension Plan Option Values

Check this box to enable to display defined benefit plan options. Data entry fields and options will change depending upon the selected plan.

Retirement Plan

Select the retirement plan from the list. Be aware that only defined benefit plans are listed and that the data entry fields and options will change depending upon the selected plan.

Entered Plan Date

Enter the date the client entered the retirement plan (service computation date for federal employees).

Additional Funds

Enter any additional funds currently in the plan.

Additional YOS

Add any additional years of service.

Survivor Benefit Options

A grid view will illustrate the options available for the selected defined benefit plan.

Cost of Living Adjustment (COLA) Options

Check this box and add a custom COLA if one is preferred to override any internal COLA built into the defined benefit plan.

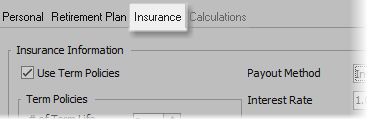

Insurance Information

Use Term Policies

Check this box if term policies are to be used in conjunction with a whole life (or universal life) policy. This may allow for reducing the monthly premium required by the client. If term policies are used, the Payout Method (selected below) will use Interest Bearing.

Term Policies

# of Term life Insurance Policies

Enter the number of term policies to illustrate for the client.

Term Policies Start

Select when the term policies are started - either today or at retirement.

Policy Grid

Enter the name and number of years for each term policy.

Payout Method

Select one of the payout methods (either Annuitize or Interest) for handling the insurance proceeds.

| Note: | Some versions of TRAK have the option of selecting custom annuity products. |

Annuity Rate at Age [X]

Enter the annuity rate for the life insurance proceeds at the specified age.

Insurance Rate on Side Fund

Enter the interest rate received on the side fund.

Whole/Universal Life Policy Name

Enter the name of the life insurance policy.

Account Balance at Spouse's Life Expectancy

Enter the desired account balance at the spouse's life expectancy on the side account. This amount may be for inheritance funds, end of life expenses or other needs.