The data input for the Paycheck Projection module is divided into two time periods: Accumulation Values and Distribution Values. Each section is described below:

Accumulation Values

The values entered here deal with the time period from now until retirement. Each is explained in more detail below:

Scenario

This is the scenario to illustrate from the Paycheck or 1040 Analysis calculators.

| Notes: | If the Projections calculator was opened right after working in the 1040 Analysis calculator, the Whole Year and Partial Year scenarios will be available in the drop down dialog. |

| Not all values are editable when working with the Current or Quick Max scenarios. |

Personal

Date of Birth

This is for display only and to confirm the value entered in the Paycheck calculator.

Retirement Age

Enter the age that the client expects to retire.

Retirement Month

Select the month in which the client expects to retire. The retirement date will be the end of the month following the date they turn their retirement age.

| Example: | If a client is born on March 15th, 1960, and plans to retire at age 60, their 60th birthday would be March 15th, 2020. If March is selected as the Retirement Month, then the retirement date would be 16 days after turning 60 (March 31st, 2020). If February is selected as the retirement month, then their retirement date would fall in the following year (February 28th, 2021), when they are 60 and 15 days before they turned 61. |

Paycheck Income

Gross Income per Paycheck

This amount comes from the previous paycheck screen. Changing this value will change the illustrated column in the Paycheck calculator.

Annual Raise

Enter the projected annual raise the client anticipates receiving

Net Take-Home Pay

This is for display only and displays the take-home pay for the client.

Retirement Accounts

401(k) Balance or TSA Balance

Enter the balance for the client's retirement account. (The account type is configured in the Employer File Editor's Retirement Plans tab).

Deposit

Enter the deposit value. The data will be either a percentage or a dollar value (the deposit method depends upon the employer file and paycheck configuration).

401(k) Roth Balance, Deposit

If the retirement account in the Employer File was configured to have a Roth account, the input fields will be listed here. Additionally, if a secondary qualified plan is visible in the Employer File Editor, the input fields associated with that retirement account will be displayed here.

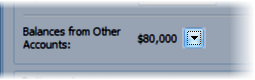

Balances from Other Accounts

This prompt displays the total balances from other retirement accounts the client may have in addition to their current retirement savings. To edit the account values, click on the down-arrow button to the right of the displayed balance.

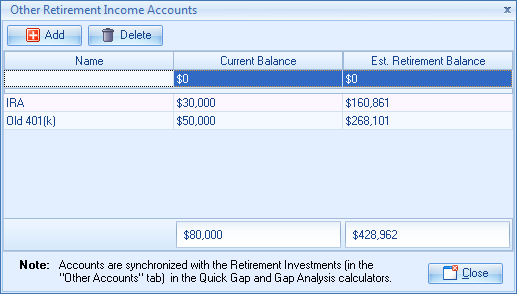

The following dialog will appear.

| Notes: | The accounts entered here will also be shown in the Quick Gap calculator. |

| Sales Talk: | A client will be motivated to share about other retirement savings accounts they have because they are being educated about how it impacts their retirement. A question like "What additional retirement savings do you have that I need to include in this calculation?" may help them open up and share about their other retirement accounts. |

Retirement

Rate of Return

This is the rate of return on the various accounts during retirement.

Cost of Living Adjustments

This is the projected inflation for the client during retirement.

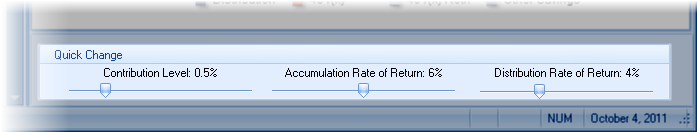

The Quick Change toolbar editors allow for speedily changing the contribution level and interest rates for both accumulation and distribution. The illustration is updated as the slider bar is moved. This is extremely effective for demonstrating how contribution levels or rates of return change the account accumulation and distribution.