Qualified plan contributions are pre-tax. Traditionally a qualified plan participant thinks of the pre-tax contribution they will be contributing to the plan, whether it is a percent of income (as often done in 401(k) plans) or a specific dollar value (as often done with 403(b) plans).

But what does that specific plan contribution mean to the participant in after tax values?

With TRAK, the approach can be different: the participant can be asked in terms of their take home pay, or more specifically, how much take home pay do they need. This value can then be entered as their take home pay, and TRAK will calculate the pre-tax retirement contribution value.

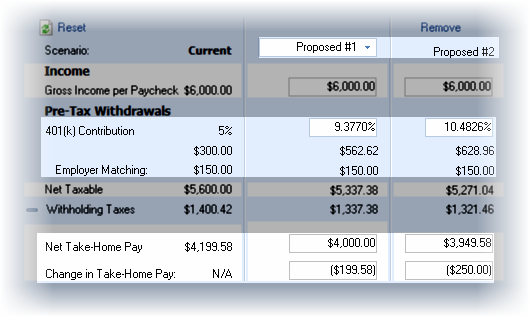

In the example above, the Net Pay for Proposed #1 was set to $4,000. For Proposed #2 the Change in Take-Home Pay was set to -250. TRAK automatically calculates the qualified plan contribution.

| Sales Tip: | In other words, ask the client, "How much can you afford to reduce your spendable income without it affecting your lifestyle?" or "How much take home pay do you need?" (the number they are familiar with). Do not ask "How much do you want to put into your 401(k)?" |

When the value has been entered, it will show the pre-tax contribution, the employer match (if any), and also the total tax savings—all potential key selling aspects of qualified plan contributions.