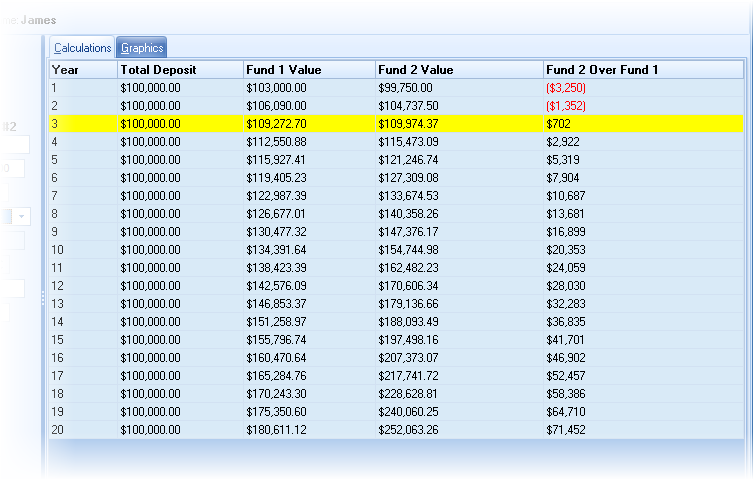

The client must pay a 5% surrender fee, but they can move the money to an account with a 4.5% rate of return. They have 20 years until the money will be needed. Should the client move their funds?

Data Entry

Prompt |

Value |

||

# of Years |

20 |

||

# of Deposits/Year |

0 |

||

Amount of Deposit |

0.00 |

||

|

Account 1 |

Account 2 |

|

Name |

Current |

Proposed |

|

Initial Value |

$100,000 |

$95,000 |

|

Interest Rate |

3% |

4.5% |

|

Bonus Type |

No Bonus |

No Bonus |

|

Bonus Value |

N/A |

N/A |

|

Term of Bonus |

N/A |

N/A |

|

Annual $ Fee |

0 |

0 |

|

Annual % Fee |

0 |

0 |

|

% Surrender Fee |

5% |

|

|

$ Surrender Fee |

0 |

|

|

Calculations

The Proposed account's value will exceed the Current account value in year 6, and in 20 years will be $26,647 ahead.