Data Options

The Data Options page allows for converting the client's income and the qualified plan percent into the values required by TRAK.

Income Conversion

If the value for the participant's income in the imported data "Income" field represents a single paycheck, choose the first option. If the value represents more than the income from a single paycheck, select the second option "Divide the "Income" value by the number of paychecks per year". The number of paychecks per will either be from the Employer File setup or, if imported, the "Pay Per Year" field. Or, if a custom calculation is preferred, select the final option "Divide the "Income" value by a custom number" and enter that value.

Note: These options are only enabled if the income field is selected in the Field Association page.

State for Withholding

Checking this box will allow for specific state withholding taxation. This field will not be enabled if the state field is left unassigned.

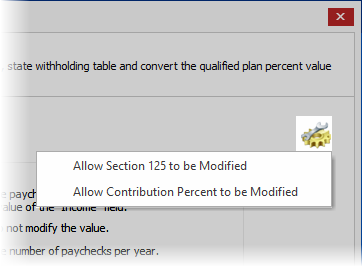

Further configuration can be set by clicking on the configuration icon (yellow gear with the wrench) and making selections.

Converting Section 125 and Qualified Plan Contribution

The configuration button (at the top-right of the window) allows for converting Section 125 and Qualified Plan contributions. Because these are untypical, they are hidden by default. To turn these on, check the respective item. The Section 125 conversion is similar to the conversion of income. The Qualified Plan contribution converts the qualified plan contribution as a percent. If the contribution value is imported as a fraction (for example, 5% is imported as 0.05), then it must be converted.