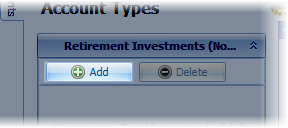

An virtually unlimited number of additional savings accounts, such as IRAs or 401(k) plans with previous employers, may be entered here.

New accounts are added by clicking the "Add Account" button.

Conversely, to delete account, select the account and click the "Delete" button.

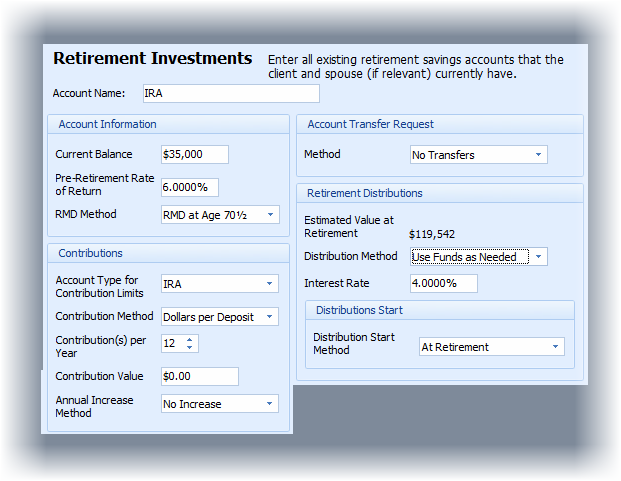

After adding an account, the account editor will be displayed to the right. The information about the account can be edited.

The prompts are briefly discussed in the following. Note that prompts that are not relevant are not displayed.

Account Name

Enter the name of the account. (The account name must be unique).

Owner

Select either the Client or Spouse. (This prompt only appears if there is a spouse configured.)

Account Information

Current Balance

Enter the current balance of the account. The account balance is assumed to be from the calculated date the last deposit occurred, but not more than 30 days old. If there are no deposits the account balance is assumed to be 30 days old.

Pre-Retirement Rate of Return

Enter the expected pre-retirement rate of return.

| Note: | For non-qualified accounts, enter the net (after-tax) rate of return for the account. |

RMD Method

Select from one of three methods for the account:

1.None: The account is not subject too RMDs (Required Minimum Distributions).

2.RMD at Age 70½: The account is subject to RMDs when the owner is age 70½.

3.Inherited RMD: The account is an inherited qualified account and is subject to inherited RMDs.

Year Inherited

If the account is subject to Inherited RMDs, enter the year the account was inherited.

| Note: | During distributions, RMDs have a higher priority than regular distributions. |

| For Inherited RMDs accounts, the RMD will not be taken out for the current year. The Current Balance entered value should be reduced by the RMD value for the current year. |

Contributions

Account type for Contribution Limits

If the account has contribution limits to be taken into consideration, select the type of account. If no limits are to be taken into consideration, select "(None)."

Notes: If "Maximum" is selected as a contribution method (below), the "(None)" option will not be available.

For "Retirement Investments" the limits for the accounts are the combined employee and employer contribution limits.

Limits are indexed to inflation in $500 increments.

Contribution Method

Select Percent of Pay, Dollar or Maximum for the contribution method.

| Note: | The Maximum method limits contributions based on the retirement plan type (e.g. for 2017 the 401(k) participant contributions are limited to $18,000) but is not limited by earnings. |

| The Maximum method is indexed to inflation (which can be configured in File/Config/Gap Analysis/Calculator). |

Contribution(s) per Year

Enter the number of times a contribution is made per year. Note that if Percent of Pay is selected as the Contribution Method, this prompt will not be available.

Contribution Value

Enter the value of each contribution: for the deposit type "Dollar," enter the dollar contribution. For the deposit type "Percent of Pay," enter the percent of pay that the employee contributes.

Annual Increase Method

Select the method for increasing the client's contribution in future years. Each method is discussed below.

No Increase

Select this method if there is to be no future increase in the contribution value. Note if the Contribution Method for the client is Percent of Pay and the client (spouse) has a raise, the dollar value of the contribution will increase when the client receives a raise, but the percent of the client's (or spouse's) pay will remain the same.

Increase in Value

This method will increase the value of the client's contribution as a value. If the Contribution method is Dollar then the increase value will be in a dollar value, and will be per contribution. If the method is Percent of pay then the contribution will be an increase in the contribution percent. Contribution increases occur when the client receives a raise.

| Examples: | If a client is currently contributing $100 monthly and selects Increase in value with a $25 increase, the future contributions will increase to $125 per contribution the first year, $150 the second year, $175 the third year, etc. |

| If a client is currently contributing 5% per paycheck and selects Increase in value with a 1% increase, the future contributions will increase to 6% the first year, 7% the second year, 8% the third year, etc. |

Percentage Increase

This method will increase the contribution by a specified percent. Increases occur when the client receives a raise.

| Examples: | If a client is currently contributing $100 monthly and selects Percentage Increase with a 10% increase in percentage, the future contributions will increase to $110 per contribution the first year, $121 the second year, $133.10 the third year, etc. |

| If a client is current contribution 10% of their paycheck and selects Percentage Increase with a 10% increase in percentage, the future contributions will increase to 11%, 12.1%, 13.31%, 14.46%, etc. |

Detail Customization

This allows customizing the future changes in contribution in as much detail as desired.

If Annual increase method is either Increase in value or Percentage increase, the following prompts will be enabled

Annual increase in percent, Annual dollar increase in each deposit or Annual percentage increase

Enter the value to increase the contribution. This field is not available if Detail customization is selected for the Annual increase method.

Number of years to increase contributions

Enter the number of years to increase contributions. This field is not available if Detail customization is selected for the Annual increase method.

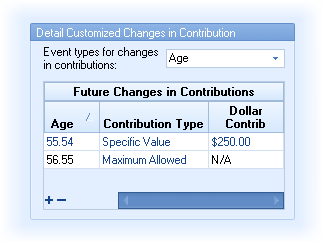

If Annual increase method is Detail customization, the following box will appear.

This dialog allows customizing when the contributions will change (either increase or decrease) at any point in the future. The prompts are discussed below.

Event types for changes in contribution

The events for increasing contributions are Age, Year and Date.

The columns in the grid are:

Age, Year or Date

The column type here corresponds to the method selected in the previous prompt and is when the change in contribution occurs.

Contribution type

Select if the contribution is a Specific Value or the Maximum Allowed. (For Maximum Allowed, see notes above under Contribution Method about Maximum).

Dollar Contrib or Percent Contrib

The value here corresponds to the Contribution method selected previously. If the Contribution type is a Specific value, enter the value the contribution will change to.

Account Transfer Request

These prompts allow for requesting a transfer from another account (which can include their DC retirement plan, TSP account, DB cash balance plan, or another retirement investment) to this account. The transfer is a one time transfer either today or at retirement.

| Note: | An illustrated transfer of funds does not indicate in anyway that the transfer is permitted or in any way guarantee that the funds can be moved. |

Method

There are five options that may be selected as the method. Each are briefly described below.

No Transfers: No funds will be transferred to this account.

Full Balance: The full balance of the other account will be transferred to this account.

Percentage: A percentage of the account balance will be transferred to this account.

Specific Balance: A specific balance will be transferred to this account.

Leave Specific Balance: A specific balance will be left in the other account when the transfer occurs.

From Account

A list of cash accounts will appear. Note that TRAK does not know or guarantee that any accounts in the list allow for a transfer.

Occurs

Select when the transfer is to occur: Owner's Retirement or Today.

The following prompts are visible based on Method selected above

Percentage

If the Method above is Percentage, the Transfer Percentage prompt will appear. Enter the percentage of the other account to transfer to this account.

Balance to Transfer

If the Method above is Specific Balance, the Balance to Transfer prompt will appear. Enter the balance (in dollar values) of the other account to transfer to this account.

Balance to Remain

If the Method above is Leave Specific Balance, the Balance to Remain prompt will appear. Enter the balance (in dollar values) of the account balance in the other account to leave in the selected account.

Transfer Amount

This will display how was transferred from one account to another.

Potential Problems with Transfers

There could be several reasons for a transfer not occurring in the amount anticipated:

1.The account has multiple transfers being made out of it. If more than one account is transferring out of the account, some or all of the transfer may not be the expected value. If multiple transfer happen out of an account, they are prioritized as follow:

a.Percentage Transfers

b.Dollar Transfers

c.Leave Dollar Value

d.Full Balance Transfers

For accounts with the same transfer method, the transfer priority occurs in the order the accounts were created.

Example #1

If an account has $100,000 and the following transfer requests are made for today:

a.Act #1 requests a transfer $20,000;

b.Act #2 requests a 50% transfer; and

c.Act #3 requests a full balance transfer.

Act #2's request will be first, transferring $50,000. Act #1's request will be second (transferring the requested amount), and Act #3 will transfer the remaining $30,000.

Example #2

If an account has $100,000 and Act #1 and Act #2 request a 20% transfer from the account.

The account created first (lets assume Act #1 was created first) would receive $20,000, and the balance would be reduced to $80,000. Act #2's request then would occur, based on the reduced balance, resulting in a transfer of $16,000.

Retirement Distributions

Estimated Value at Retirement

This is a calculated field and may not be edited. It calculates the estimated value at retirement.

Distribution Method

This is the method for distributing the account.

Rate of Return

Enter the retirement rate of return. For annuitized accounts, enter the annuity rate.

Annual Percent to Distribute

For Percent of Account payout method, enter the percent of the account to payout on an annual basis.

Distribution Start

Distribution Start Method

If distributions from the account are to start after retirement, select the method to start the retirement benefits. Note that all qualified accounts will be subject to required minimum distributions on the last distribution of the a year.

Starting Value

This corresponds with the prior prompt and is the value for starting the account distributions.

For additional control over distributions, read the Controlling Distributions entry in the Frequently Asked Questions for Gap the Gap Analysis calculator.

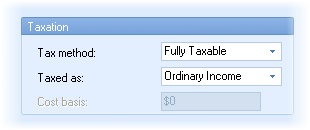

If the Tax Wise Distribution Strategy is selected in the Setup tab, the following prompts will be required.

Taxation

Tax Method

Select the tax method of the account. The options are Tax free, Above cost basis, Above cost basis and deposits, Fully taxable.

Taxed As

If the account is taxable, select how the money is taxed--either as ordinary income or capital gains.

Cost basis

If the Tax method indicated the account had a cost basis, enter the cost basis for the account.

End of Year Transfer Funds Options

The Tax Wise Distribution Strategy allows clients to move monies out of taxable accounts into after-tax accounts over retirement. This can reduce taxation on the client's estate at life expectancy.

| Note: | Transfers are only available for non-annuitized taxable accounts. |

Transfer funds to a different account

Check this box to illustrate a transfer.

Transfer start age

Enter the age to start the transfer. The age should be after retirement.

Years to make transfer

Enter the number of years to make the transfer.

Transfer method

TRAK supports 3 types of transfer methods:

Dollar value per year

Enter the amount to transfer per year.

Tax bracket limit

This method will keep all transfers at or below a specific tax bracket.

Annual minimum distribution

This method will require a minimum amount of distribution from the account during the transfer period.

Annual transfer value or Maximum tax bracket or Annual min. distribution

Enter the value corresponding to the transfer method

Target account

Select the target account for the transfer. If the account does not yet exist, it can be created and then return to this tab.

Increase in transfer: Before transfer and During transfer

If the transfer method is either Dollar value per year or Annual minimum distribution, enter the annual increase in the value both prior to and during the transfer.