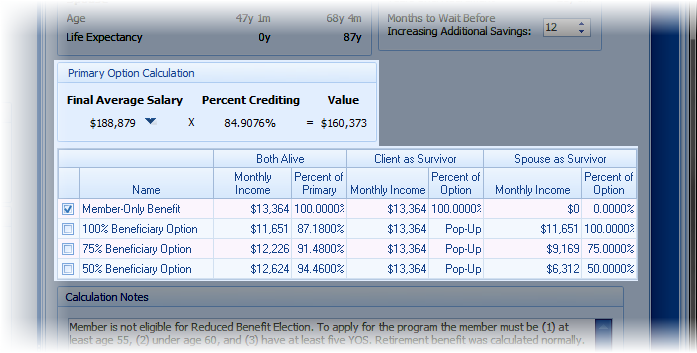

When a defined benefit plan is selected for the retirement plan, the lower section of the screen will appear similar to what appears below:

| Note: | When working with defined benefit plans that integrate with Social Security, the Primary Option Calculation group box will appear differently; illustrating how the integration with the Social Security calculation was performed. |

The areas on this screen are discussed below:

Primary Option Calculation

This illustrates how the retirement plan's primary option is calculated showing:

1.the Final Average Salary,

2.the Percent Crediting,

3.possibly the Years of Service (shown if the same crediting rate is used for all years of service, and

4.the Primary Option Value.

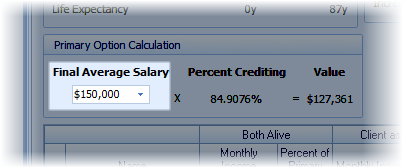

TRAK allows for three different methods for arriving at the Final Average Salary (Exact [default], Rounding, and Manual). This is done by clicking on the drop down box to the right of the final average salary value, which brings up the following pop-up window:

If the client has been provided a projection by their retirement system, you may want to select the final average salary (FAS) method that most closely matches it. You may also select manual and enter the value.

| Note: | When Manual is selected, the FAS value can be edited in the main screen. When this is the case, click on the button to the right of the editor to change the FAS method. |

|

| When Manual is selected, some of the comparison options on the Savings Analysis calculation page will no longer be available because the calculations on the page require changing the retirement date. |

FAS Methods: Rounding, Exact and Manual

TRAK has three different methods for determining the final average salary (FAS):

1.Rounding: This method is most typical of projections provided by pension systems. The FAS is calculated by annualizing the current income and not paying close attention to when the client receives a raise.

2.Exact: This method pays more attention to when the raise occurs and may provide a better method for determining what the FAS will be.

3.Manual: This method allows for overriding the calculated FAS value and entering the value manually.

DB Options Grid

The DB Options Grid displays the values for the various options for the member. The columns visible in the grid (and other options) can be configured in the DB Grid Display Options configuration panel.

Plan Notes

For certain retirement plans, calculation notes may be provided. The notes will normally appear below the options grid (similar to what is shown here).

| Note: | If the member does not have enough years of service at retirement to qualify for retirement (including both normal retirement and early retirement) the income for the primary option value will be zero and none of the alternative options will be displayed. A plan note will be displayed indicating that the member did not have enough years of service. |