Side Fund Example #1

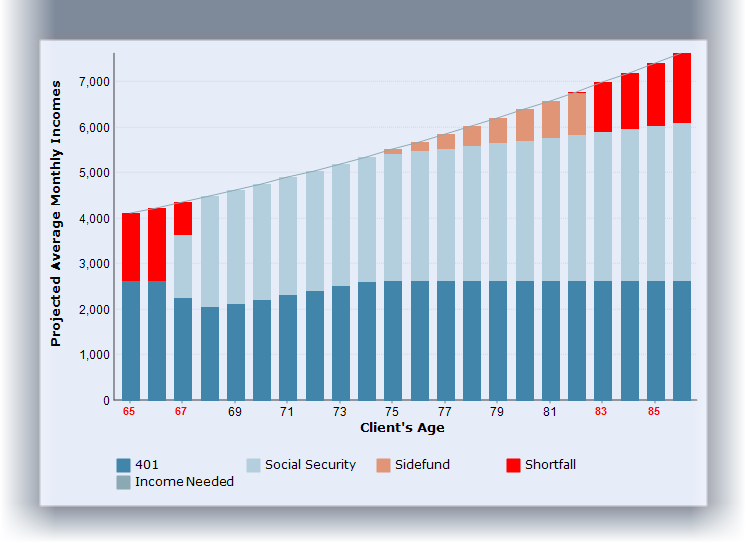

Suppose a client wants to retire at age 65 and has only two retirement accounts: Social Security (starting at age 67) and a 401(k) account. The selected payout method for the 401(k) account is "Amortize with inflation." For this example, the Retirement Years chart appears below:

Items to note about the image above:

1.Starting at age 67 the client has plenty of income (due to the payout method of the "401(k) - Custom" account).

2.Because of the restricted distribution method for the 401(k) account, there is a shortfall for the years prior to age 67.

In this example, if TRAK used the client's retirement account for calculating additional savings, the additional savings would have to be excessive to get the amortized distribution of the account to fund the early retirement years.

To avoid this problem, either change the distribution method of the account to "Use Funds as Needed," or, if using the Gap Analysis calculator, on the Setup tab check the box to allow access to restricted funds.

.

.