Understanding the Side Fund

What does the "Side Fund" refer to?

An account named "Side Fund" may appear in a number of the Gap Analysis and Quick Gap calculators' calculation screens. This account serves two purposes:

1.It is the account that is used for calculating any additional savings needed.

2.If there is excess income in retirement for any reason, this income is put into the "Side Fund" to be used for later years. This may occur due to the RMD (Required Minimum Distribution) or a sale of an asset.

Side Fund Distribution Method

Because the side fund is used to fund shortfalls any time in retirement, its distribution method is pre-configured to "Use funds as needed."

| Example: | If an illustration has a temporary shortfall prior to Social Security payments starting but sufficient income after the payments start, any other distribution method than "Use funds as needed" would result in a significant increase in savings. |

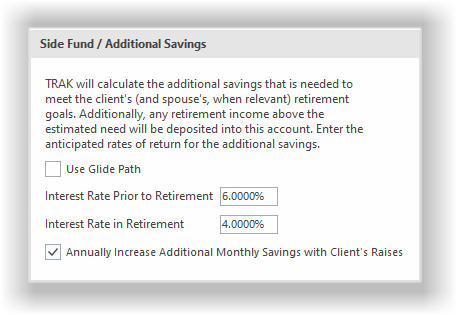

In the Quick Gap calculator, the interest rates for the Side Fund (before and during retirement) are set in the "Other Accounts" tab (far left of the screen), click on the "Side Fund" item in the Account Types panel:

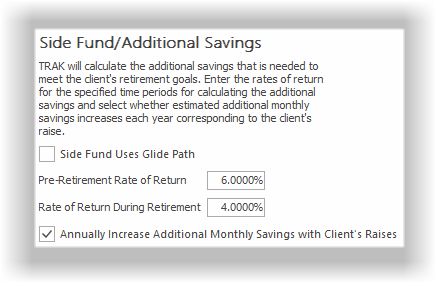

In the Gap Analysis calculator, the interest rates can be set in the "Setup" tab: