Federal 1040 Calculations Paycheck

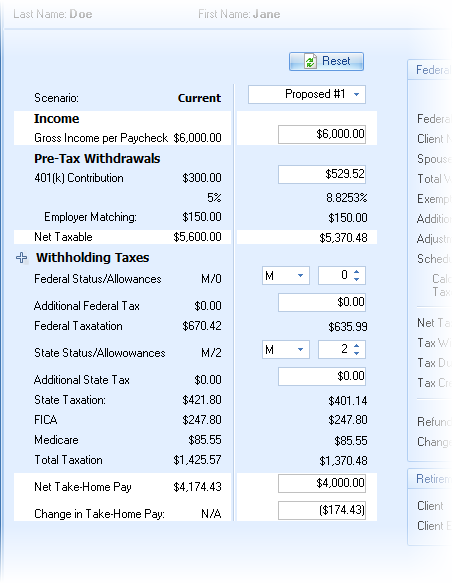

The 1040 Calculation screen presents the paycheck information (showing the current paycheck and one other scenario) and federal 1040 calculation (showing the current 1040 return and another scenario associated with the alternative paycheck scenario).

Paycheck Data

The paycheck information on the left is very similar to what is shown in the opening paycheck calculator, and only the difference (initial Scenario prompt) will be discussed.

Scenario

This allows for selecting which paycheck to illustrate the effects of. There are five options for selecting:

Quick Max: This illustrates the maximum allowable contribution over the whole year. It does not take into consideration year to date information.

Proposed #1 and Proposed #2: Illustrates alternative paychecks and federal returns for the client (and spouse).

Whole Year: Illustrate how changes to the paycheck may effect the federal return over the whole calendar year.

Partial Year: The factors the refund only for the paychecks remaining in the current year. Note the discussion and warning below on using this option.

The first three items (Quick Max, Proposed #1, and Proposed #2) are the same paycheck calculations from the front screen.

The last two scenarios (Whole Year and Partial Year) automatically illustrate factoring of the federal refund over the whole year or remainder of the year (when year-to-date data was entered), by increasing the number of allowances. (In the example above, the federal and state allowances were increased from 0 to 9.) The increase in pay is automatically deposited to their qualified plan.

| Note: | The initial Take Home Pay calculated for the Whole Year and Partial Year paychecks will be taken from the active paycheck when the 1040 data input screen was opened. |

Whole Year and Partial Year

The Whole Year scenario factors the projected federal refund to the qualified plan over all of the paychecks in the calendar year. If the changes the client will make to their paycheck withholding options are not early in the year, and year-to-date information was entered, TRAK also calculates what the allowances may be changed to for the remainder of the year (Partial Year). Partial Year is a more aggressive approach.

| Warning: | If a client elects to use a more aggressive Partial Year election, they will need to change their W-4 filing at the end of the current calendar year. Otherwise, they may have a severe tax bill due at the end of the following year. |

Because of the problems that could be created when working with the Partial Year election, the following steps are strongly recommended:

1.Have the client fill out a salary reduction agreement and a new W-4 to increase the number of withholding allowances to the Partial Year values. Send this to the payroll department.

2.Also, have the client fill out a salary reduction agreement and W-4 that goes into effect January 1st of the following tax year, reducing the qualified plan contribution to the Whole Year recommended values.

3.Set up a file for the forms to be mailed in January.

4.Depending on the cutoff date for payroll, send the January forms (salary reduction agreement and new W-4) to the payroll office to be processed.

5.Send a letter to the client, along with a business reply envelope, asking them to check the first paycheck in January to confirm that the payroll office correctly processed the paperwork. Request that a copy of the paycheck stub be sent to you.

6.If you do not receive a copy of the paycheck stub by the next payroll cycle, call the client to confirm that the change has taken place.