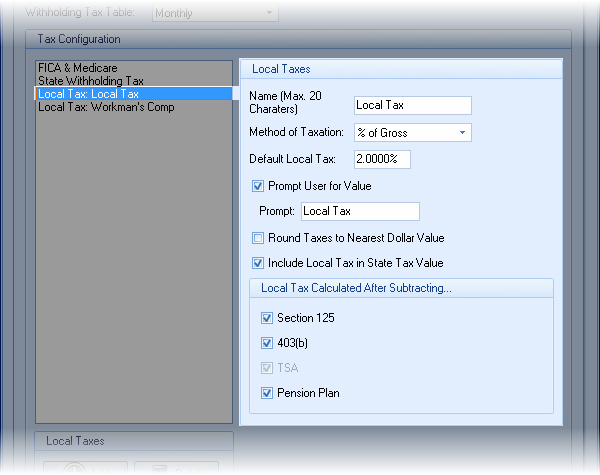

Up to nine local taxes can be added to the Paycheck illustration.

When Simple is selected as the Editor Mode the Local Withholding Tax has an additional Include Local Withholding Tax to include or exclude state withholding tax from a paycheck illustration.

Name of Tax

Enter the name of the tax that is to appear in the Paycheck calculator.

Method of Local Tax and Default Local Tax

Enter the method for local tax. Enter the default rate that corresponds to the local tax method.

| Note: | New York City and Yonkers taxes are selectable when 'New York' is the selected withholding tax table state. |

Prompt User for Value

If each paycheck needs to override the default rate, check this box. An input field will appear in the Paycheck calculator.

Round Taxes to Nearest Dollar Value

If the taxation is rounded, check this boxes.

Include Local Tax in State Tax Value

If this specific local tax is to be included in the state withholding tax value rather than stand on its own (this is typically done in the State of Maryland).

Local Taxes Calculated After Subtracting...

If the Method of Local Taxes is Percent of Gross, these options will be available. Check the appropriate boxes.