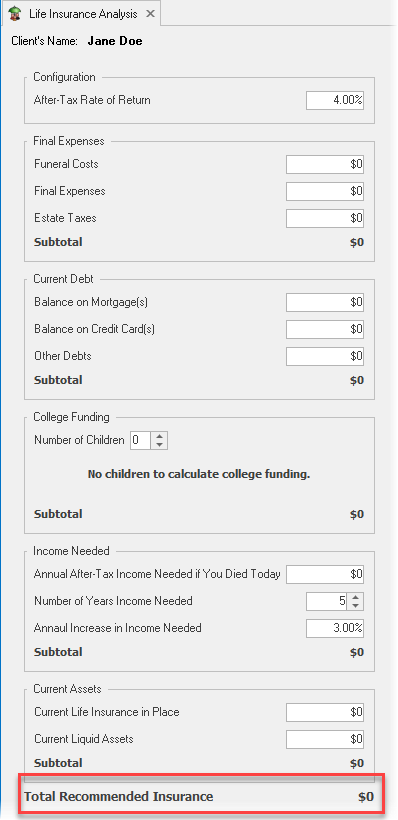

Life Insurance Calculator

This calculator provides a quick estimation for a client of their need for additional life insurance. By entering values in each section, The Retirement Analysis Kit will calculate the total insurance needed at the bottom of the screen.

Life Insurance Need Categories

The Life Insurance Need calculator divides the need into various categories. Each category discussed below.

Configuration

This contains the after-tax rate of return earned by the life insurance. It is used for items listed below that are not needed immediately should the client pass away (e.g income for future years). A conservative rate of return should be used.

Final Expenses

These are expenses at the client's death (including funeral costs, memorial service) final expenses (such as unpaid medical expenses) and taxes due.

Current Debt

List all debts the client has remaining.

College Funding

Enter funding for colleges for various children. Each child is itemized in the list.

Income Needed

Enter income needed by the spouse and/or children after the client has passed away.

Current Assets

Current assets reduce the need for estate. If liquid assets include taxable assets (e.g. retirement accounts), include only the after-tax value of the assets.