Solving Funding

The Solving Funding option allows for automatically changing the assumptions for an illustration when the funding change falls outside of specific limits. In other words,TRAK will adjust a client’s contributions up or down according to what the threshold limits allow in order to address retirement income shortfall or gap.

To enable this feature, check the box "Adjust Illustration when Unable to Provide Solution".

Then, after the limits are met, TRAK will additionally suggest other changes to handle the shortfall or gap in income for retirement by altering either/or retirement age, use of social security and retirement income levels.

| Note: | These options only impacts the Participant Gap Analysis reports. It will not modify the scenarios for the Participant Benchmark reports. |

| Example: | An illustration requires a participant to increase their deferrals from their current 4% contribution to 27% contribution. A dramatic increase in the participant's contribution may alienate the participant and disengage them from any further conversation. This problem may be overcome by using the Contribution Change Threshold. TRAK can automatically alter the client's assumptions to reduce the significant increase to a more reasonable value. (Similarly if a client is over-funded, the illustration can alter the assumptions so that they can show a minimum increase in deferrals). |

The changes to the scenario can be any of the following items

1.Change reliance on Social Security

Especially relevant for over-funded participants, this will alter the percent of the estimated Social Security the client will receive.

2.Change retirement age

The illustrated retirement age can be altered by the client. For example, for an under-funded client

3.Change percent of income needed in retirement

The illustrated percent of income needed can be altered.

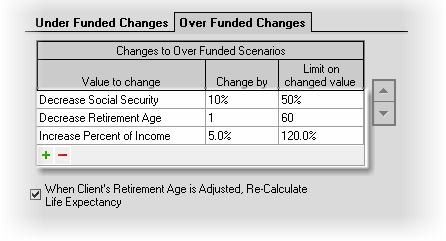

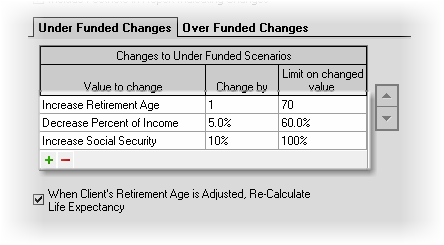

Changes to over funding scenarios and Changes to under funded scenarios

Include Footnote in Report Indicating Changes

If changes are made by TRAK because of the threshold exception, checking this box will include a footnote indicating what changes were made. In general, in over funded situations TRAK will try and allow a client to retire at an earlier age, have more income for retirement, and/or decrease reliance on social security along with an increase in their contribution. Conversely, in under funded situations, TRAK will try and delay their retirement age, decrease their retirement income and/or increase their reliance on social security.

If an illustration falls outside of the funding threshold, the data will be changed per the steps shown in the relevant grid. Each step is taken in order. For example, in the following over funded grid:

the scenario will be altered first by reducing the current illustrated retirement age by one year. The scenario will be re-run to check if the minimum funding threshold is met. If it is not, the process is repeated until the client's age is 60. If at age 60, the minimum funding threshold is not met, the second step, and if required, the third step are taken. (Note: that additional steps may be added. For example, after the above three steps, if the scenario still has not met the funding requirements, an additional reduction in the retirement age may be illustrated).

The under funding grid below shows the steps taken when a client's proposed scenario exceed the maximum increase threshold.

| Note: | Altering a client's scenario may result in the scenario falling outside of the other funding threshold limit. If this should occur, the other threshold will not be checked and the contribution will be out of range. |

| Example: | If a client's retirement age is increased from 65 to 66 because of underfunding, and the change in the recommended contribution results in the client being outside of the over funded scenario, the over funding threshold is not considered. |

When Client's Retirement Age is Adjusted, Re-Calculate Life Exptectancy

Check this box to enable this option for life expectancy re-calculation in the case of a retirement age adjustment.