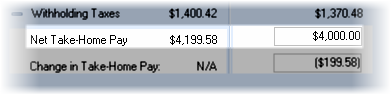

The take home pay may be set to a specific value in either the Proposed #1 or Proposed #2 paychecks. Enter the desired take home pay and press the tab key. TRAK will calculate the new pre-tax qualified plan contribution.

| For Example: | The Net Pay was set to $4,000. The change in pay affected the primary qualified plan contribution. |