TRAK Solutions

Retirement Needs Analysis

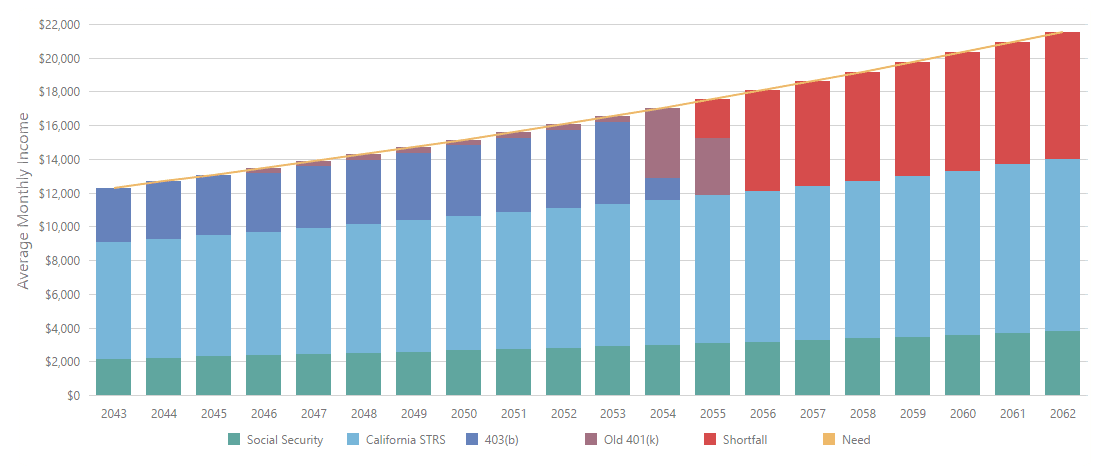

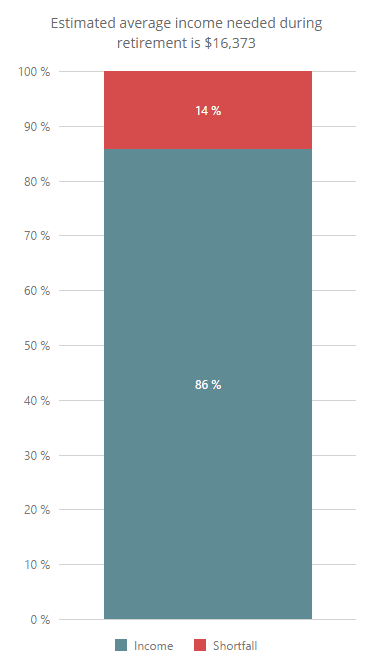

Gap Analysis

Sometimes clients need to see the “gap” before they are motivated to change. TRAK-Online’s Gap Analysis calculator provides a rapid, visual gap analysis of a client’s retirement needs.

The Gap Analysis calculator offers the following features:

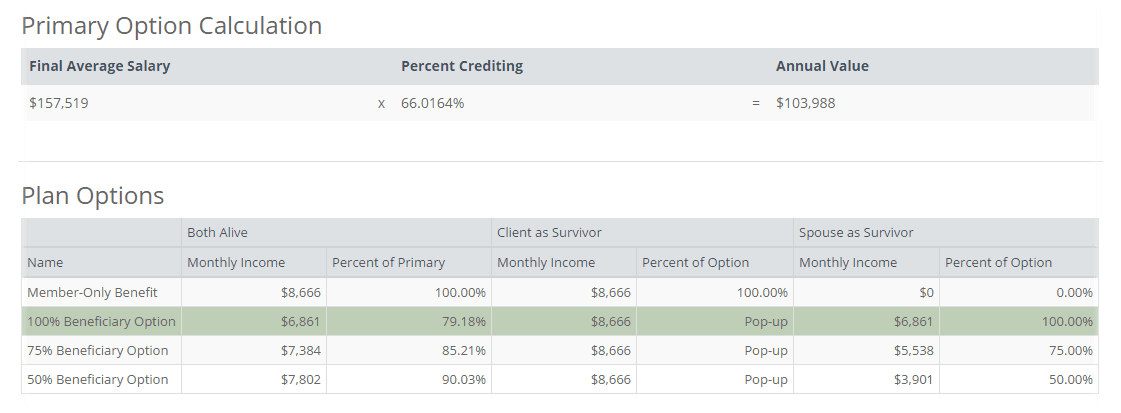

1. Illustrate a client’s retirement plan values clearly and quickly.

2. Communicate in a way that your client understands, easily switching between high-level overviews and detailed cash flow analyses.

3. Create customized 401(k) retirement plans that include the employer’s matching for both pre-tax and Roth accounts.

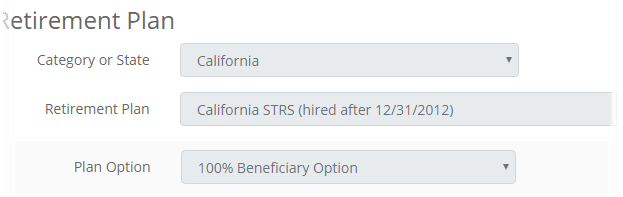

4. When working with a 403(b), TRAK includes over 700 public pension plans.

TRAK-Online calculates the various defined benefit pension plan options, and includes many cash balance options (DROP, PLOP, PLS, etc.) that are offered by many defined benefit plans.

The Gap Analysis calculator also includes federal retirement plans, and ability to illustrate the Thrift Savings Plan (TSP), Federal Employee Group Life Insurance (FEGLI), and their long-term care benefits.

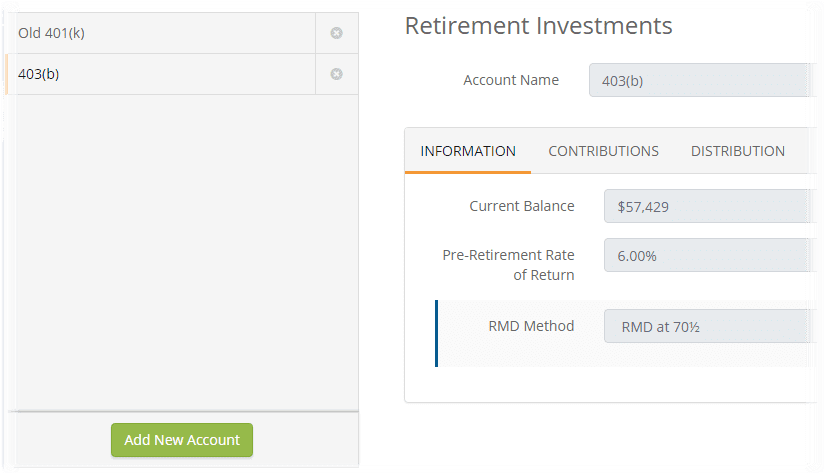

5. Easily add outside accounts including retirement investments, known income (such as outside pensions, part-time work, etc.) and lump sum accounts.

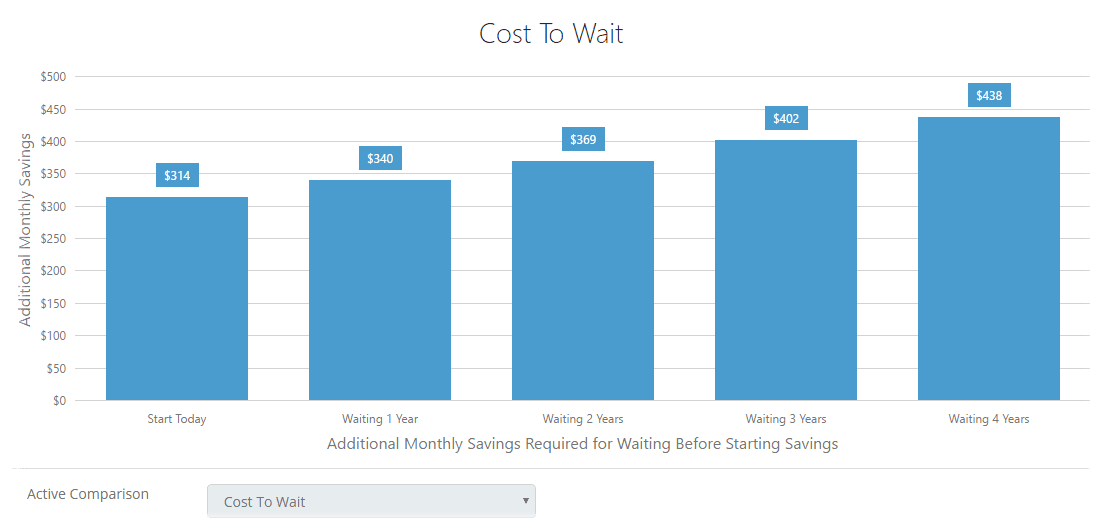

6. Compare the effects of waiting before saving additional monies, the effects of retirement age, the effects of inflation, and more with a click of the mouse button.

The Gap Analysis calculator provides efficient and effective tools for helping clients understand where they are in their retirement planning and their options for retiring successfully.