Pension Maximization

The Pension Maximization calculator provides a powerful illustration for clients taking a higher income option from a defined benefit plan and purchasing life insurance. The life insurance proceeds are used to provide their spouse (or other beneficiary) an income in lieu of selecting a lower income option for the client that provides the spouse an income. The steps for Pension Max are:

Today:

1.A client takes a higher income option, and

2.The client purchases life insurance to provide income for a surviving spouse.

When the client passes away:

3.The spouse invests the life insurance proceeds conservatively to provide himself/herself an income stream for the remainder of life.

If the retirement plan has additional benefits to the spouse besides income (such as health insurance), TRAK allows for the client to take the second highest income option (having a smaller spouse benefit). Thus, providing a higher level of income to the spouse than the option would have otherwise provided. If taking a reduced annuity option and replacing a reduce option, those proceeds would be added to insurance proceeds (plus interest gained and after taxes removed) to achieve the needed after tax income for the option being replaced.

The Pension Max calculation assumes two things:

1.The client dies soon after retiring, and

2.The life insurance proceeds are used to provide income to the spouse.

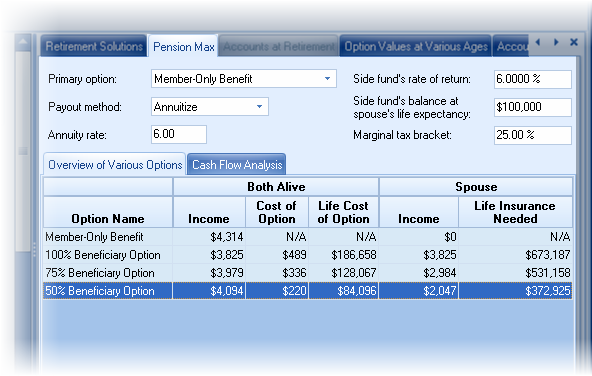

TRAK will calculate the amount of insurance required for each alternative option. The grid below shows the insurance needed to replace the income from the various options:

The various aspects of Pension Max are discussed in the links below: