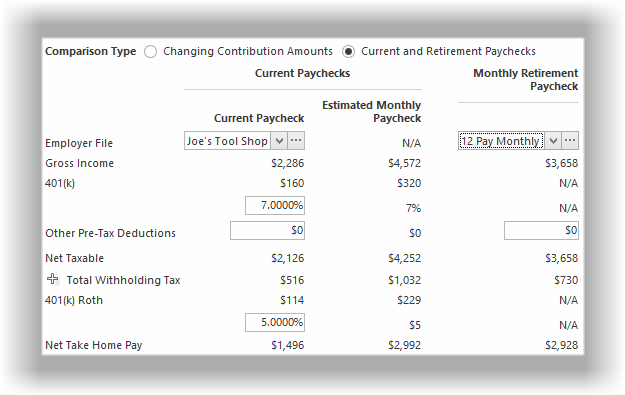

Current vs. Retirement Paychecks

A retirement paycheck has different withdrawal options that a pre-retirement paycheck. For example, a pre-retirement paycheck may have pre-tax contributions and/or after-tax contribution to a retirement plan, pension plan contributions and local taxes. Distributions during retirement won't have retirement plan contributions, may or may not have local tax contributions, but often will have Medicare withdrawals. This Paycheck Comparison tool allows yo to quickly compare a pre-retirement and "retirement paycheck" for your client.

There can be between two and four columns displayed:

1)A Client's Current Paycheck.

2)A Spouse's Current Paycheck (if a spouse is included in the retirement planning illustration).

3)A current Estimated Monthly Paycheck (displayed if the client is not being paid monthly, or if the spouse's included in included in the illustration). This paycheck shows a monthly equivalent of the client's and spouse's (when relevant) paychecks for comparing with the retirement monthly paycheck.

4)And a Monthly Retirement Paycheck.

If the client is not paid monthly, or a spouse is included, then a monthly equivalent check is illustrated.

| Note: | If the client plans to switch states during retirement, an Employer File can be created specifically for the retirement paycheck that reflects retiring in a different state withholdings. |

Except for Medicare (discussed below) the data entry fields Current vs. Retirement Paychecks (this section) are the this section Current vs. Proposed Paychecks (above). See Paycheck Data Entry (below) fields section for a description of the data entry values.

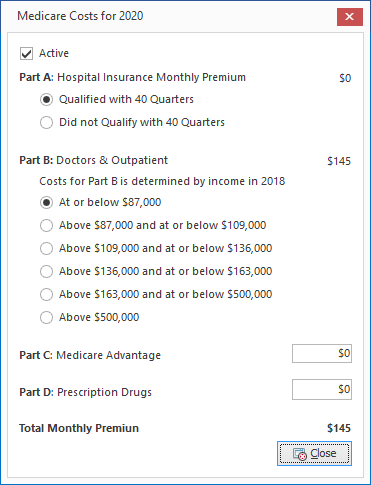

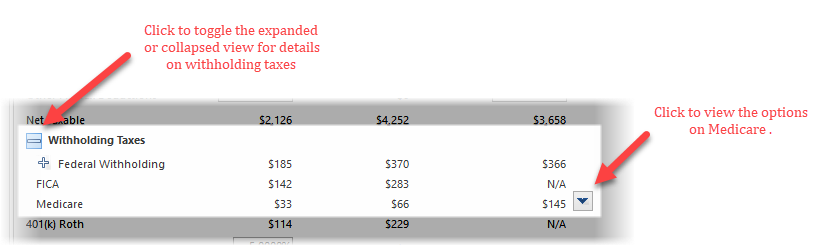

Medicare

The options on Medicare are available by expanding the the Withholding Tax values and clicking on the button to the right of the retirement Medicare value.

The options for Medicare will be displayed. For more information on Medicare, visit www.Medicare.gov.