Retirement Income Tab

The Retirement Income tab configures what the client and spouse require for incomes during their retirement years.

The prompts for this screen are discussed below:

Method for Calculating Retirement Income

The income need method can be one of the following options:

1.Percent of Income when the Individual(s) Retire(s)

Uses a percent of income of the client's and spouse's income at the time of their retirement.

2.Values expressed in Today's Dollars

Enter the retirement income for the client's income and spouse's income (when relevant) needed in today's dollars. The value will be inflated by the pre-retirement COLA value.

The Retirement Budget allows for itemization of retirement needs, with optionally customizing the specific COLA, start date and end date, and expense frequency per expense. For example, a client may have a mortgage payment with no COLA and ends at a specific age. These types of expenses could easily be addressed in the retirement budget method.

Cost of Living Adjustments (COLA)

Enter the anticipated inflation both prior to and during retirement. (When using the Retirement Budget method, the COLA values may be overridden in each of the budget items. For example, with health insurance and related costs, a higher COLA may be used than the default COLA).

Cash Balance at Life Expectancy

If a cash value is desired at life expectancy (e.g., for inheritance or risk reduction of a longer life expectancy) enter the value here.

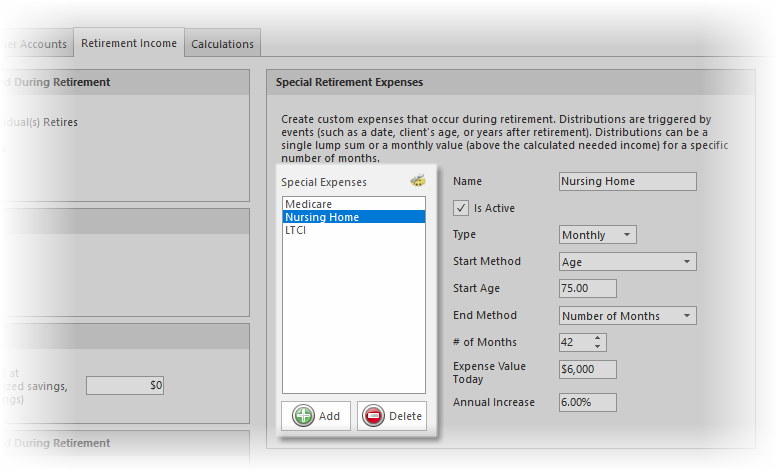

Special Retirement Expenses

This table allows for creating special retirement distributions. They can be for single events, such as vacations; or they can cover monthly, long term care type events.

| Note: | This is not visible if "Retirement Budget" is the method for the retirement income. |

| Sales Idea: | This can be very effective in showing a client the need for long term care insurance. In the data above, the nursing home expense could be added first for 36 months. The Retirement Years chart could then be displayed showing the significant impact a nursing home could have on the client's retirement account(s). Then, returning to this tab, add the long term care policy and reduce the nursing home time to 3 months (or whatever waiting period the long term care policy requires). And then return to the Retirement Years chart. |

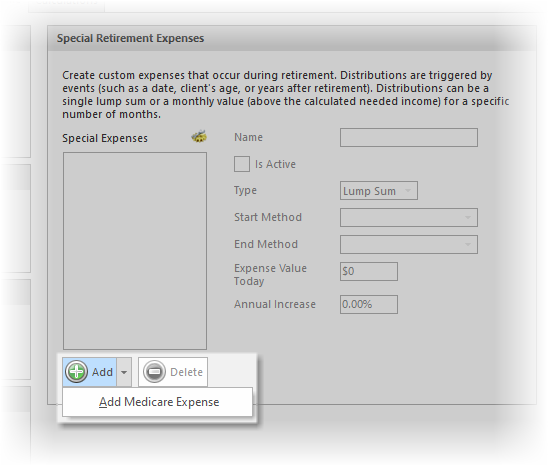

| Medicare: | To illustrate a Medicare for a retirement expense, it can be added by clicking on the down arrow next to the “Add” button. If the arrow is not visible, a Medicare expense has been previously added. |

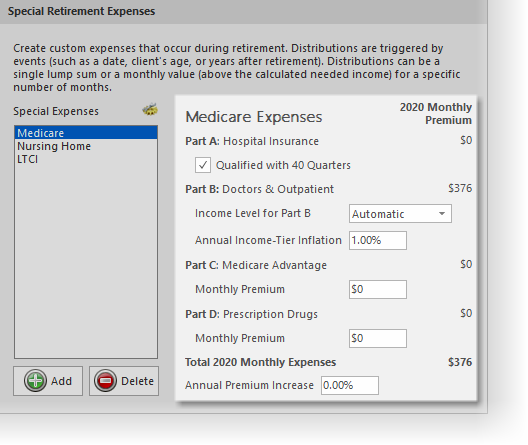

When added and highlighted, a custom Medicare editor displays which follows the current structure of the Medicare program (Part A-D). Also, additional editors are available when a spouse is shown.

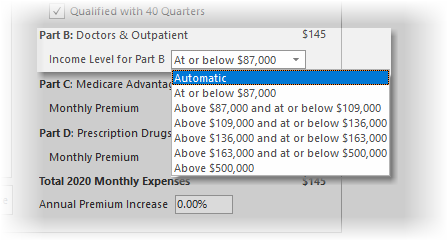

For Part B, there are several options for income including “Automatic”.

If this option is chosen:

1.An additional prompt is displayed “Annual Income-Tier Inflation” that inflates the tiers associated with the income for calculation purposes.

2.The income is for two years prior and is from the following values:

•For pre-retirement, the spouse and client incomes are annualized. Pre-tax deductions are not taken into consideration.

•For retirement, it depends upon which model is used:

▪For “Tax-Wise Distribution Strategy”, it uses the taxable income, including income subject to capital gains.

▪For tax neutral (the default strategy), it uses the income for the year.