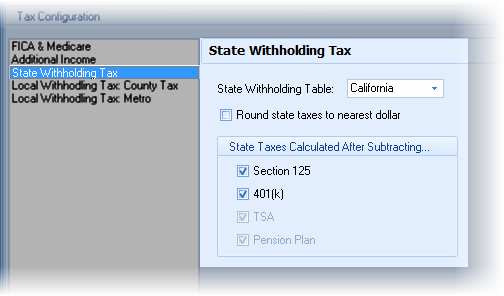

State Withholding Tax

Configure the State Withholding Tax in this screen. The prompts in the Paycheck calculator will be configured to the states withholding tax options.

When Simple is selected as the Editor Mode the State Withholding Tax has an additional Include State Withholding Tax to include or exclude state withholding tax from a paycheck illustration.

| Notes: | Some state qualified plan contributions are taxable (this includes both Pennsylvania and New Jersey at the time of this writing). In such states, un-check the qualified plans so that the state withholding tax can be calculated properly. |

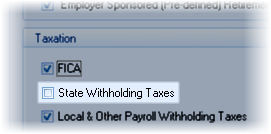

| For efficiency, if the employer's state does not have state withholding tax, un-check the State Withholding Tax box in the Visible Fields tab. |